| |

Midterm

Notes:

- If your answers are not legible or are otherwise difficult to follow, I

reserve the right not to give you any points.

- If you cheat in any way, I reserve the right to give you no points for the

exam, and to give you a failing grade for the course.

- You may bring in sheets with formulas, but no worked-out examples, or definitions,

or anything else.

- You must explain all your answers. For the quantitative questions, you must

show your formulas and your computation, else you may get no credit at all.

- Answer questions 3, 4 and 5. Answer any one of questions 1 and 2.

1. (20 points) Read the article below from the Wall Street Journal of March 3 and and answer the following question:

Investors are willing to pay money for shares in corporations because coporations earn profit. The P/E ratio can be thought of as a way of relating the price of a share to the firm's profits per share. That is, if the P/E ratio for a particular firm is 20, it means that investors are willing to pay $20 for every dollar in earnings for that firm. Alternatively, we could say that it costs $20 for an investor to get the rights to a firm earning $1/share. Hence the P/E ratio is a sort of price. Here's how analysts use the P/E ratio. Suppose an analyst wants to price a stock earning $4.30 per share. He looks at a set of other stocks thats are similar to the stock in question; he finds that the average P/E ratio for that set of comparison stocks is 15.30. Using this, he estimates the price of his stock as 15.30($4.30) = $65.79.

Why does David Geffen, the author of the article below think that P/E ratios are not appropriate in today's economy? Use the explanation of P/E ratios above to help you answer the question. Try not to simply repeat sentences from the article.

To P/E or Not to P/E? That Isn't the Appropriate Question With Earnings Falling, Valuation Metrics Mean Little

A look at the Dow industrials shows that the entire late-1990s bubble, not to mention the rally from 2003 to 2007, has been completely washed away.

With the Dow closing below 7000 for the first time in more than 11 years, one can't help but wonder, using traditional valuation metrics, whether stocks are finally falling to appropriate levels.

It mightn't be the right question to ask.

"Valuation is the wrong concept in a secular bear market," says John Mauldin, president of Millennium Wave Investments in Dallas. "If we continue to see earnings drop from forecasted levels, as we have for over a year, then it is possible we could see more pain. Valuation is subjective in such a climate. When earnings start to stabilize, and we can get some visibility, then we can talk about fair value."

The current market climate has drawn comparisons to the mid-1970s, when investors dreaded coming into work, knowing the markets were in for a rough time. With that kind of despair ruling the market, "what's the difference between 12 times or eight times or 10 times earnings? There isn't demand for equities, because people can't see any signs of recovery soon," says Peter Boockvar, equity market strategist at Miller Tabak. He contrasted this with the late 1990s, when "expensive got more expensive."

The problem, according to investors, is that S&P 500 earnings expectations are constantly changing, as analysts reduce their expectations for per-share earnings. As of a few weeks ago, analysts anticipated per-share operating earnings to come in around $69 in 2009, according to Thomson Reuters, but that figure (already reduced from some kind of previously ridiculous estimate) has come down in the last few weeks, and now the expectation is for earnings of about $50 to $55 a share for the year.

Using a typical valuation at the market's nadir -- a price-to-earnings ratio of anywhere from eight to 12 times earnings -- that puts the S&P 500, optimistically, at 660. It only broke through 700 Monday. So even a more optimistic outlook still suggests more pain.

Market strategists, until recently, were quick to dismiss the consensus, knowing it was too high -- but now they are concerned that even the reduced revisions mightn't capture the depth of the economic decline. "The risk is to the downside if the economy substantially worsens from the levels we currently see," says Fred Dickson, director of private client research at D.A. Davidson. "It's a downward moving target at the moment, and the valuation metric has just been very tough to put one's finger on."

2. (20 points) Read the following article, "GGP to Ask Bondholders for Extension ," by Kris Hudson which appeared in the March 9, 20089 WSJ and answer the following question:

In class, we learnt: "When a corporation is unable to pay its debts, the creditors are entitled to seize its assets in compensation for the default.

To prevent this, the management may negotiate with creditors or may file for bankruptcy protection.

In bankruptcy, management is given the chance to reorganize the firm and negotiate with creditors without fear of assets being seized.

This allows for an orderly liquidation or for an orderly transfer of control to creditors." The article below talks about General Growth negotiating with its creditors outside bankruptcy! Is this good or bad for creditors -- if you were advising the creditors, how would you advise them? Do you think General Growth is acting in a way that is good for its shareholders? Should they have gone into bankruptcy instead? Explain all your comments.

General Growth Properties Inc. intends on Monday to begin formally soliciting holders of $2.3 billion of its bonds to grant the mall giant another nine months of breathing room as it juggles its debts and strives to avoid bankruptcy.

General Growth will start a so-called consent solicitation requesting that each bondholder abstain from demanding payment of principal and interest on the debt for the balance of this year, though interest will continue to accrue, according to people familiar with the matter.

General Growth needs the vast majority of its bondholders to agree to the deal so that it can stay out of bankruptcy court. All told, General Growth has a debt load of $27 billion, including $395 million in bonds coming due March 16 and another $200 million in April. The company lacks the cash or borrowing capacity to pay or refinance its debts as they come due, so it is asking its lenders to extend its payment deadlines as it tries to sell assets and restructure its balance sheet outside of bankruptcy court.

In theory, approval from most of the bondholders is likely, because General Growth negotiated the consent solicitation with two advisory firms representing roughly 60% of its bondholders, people familiar with the talks say. Those advisers are law firm Paul, Weiss, Rifkind, Wharton & Garrison and investment banker Houlihan Lokey Howard & Zukin.

Representatives of General Growth and Paul, Weiss declined to comment late Sunday. General Growth, based in Chicago, owns and manages more than 200 U.S. malls, ranking it as the second largest U.S. mall company behind Simon Property Group Inc.

Yet, even if General Growth successfully recruits nearly all of its bondholders to agree to the consent solicitation, the company still runs the risk that a handful of holdouts could file an involuntary bankruptcy petition against it. The consent solicitation isn't a pact that can be applied to the entire group so long as the majority approves it; Rather, it applies only to those who accept it. Thus, a dissident group as small as three investors each owning several thousand dollars of General Growth bonds could instead attempt to haul General Growth into bankruptcy court.

General Growth has struggled for the past year to refinance its debt and extend payment deadlines as the capital crisis deprived it of the lending sources it had relied on to finance its rapid growth. Its stock has declined by 99% in the past year, closing Friday at 33 cents, as investors have fretted about a possible bankruptcy.

3. a. (10 points) Use the information in the following article ("Miners Hedge Bets as Metal Prices Fall, WSJ, Mar 1, 2009)

to discuss the function of futures markets in the financial system.

You don't have to restrict yourself to the information in the article. Do not write more than one page.

LONDON -- A handful of miners are locking in metal prices by hedging their production, a sharp departure for an industry that had only recently sought as much exposure as possible to commodity prices.

Most miners abandoned forward sales of metals in recent years, and many worked to unwind hedge books. That was largely because of pressure from investors, who bought the shares, particularly those of precious metals companies, as a proxy for the underlying commodity.

![[Silver Futures]](http://s.wsj.net/public/resources/images/MI-AV319_COMMOD_NS_20090301194834.gif) But prices of most metals have since tumbled. In recent weeks, London-listed silver miner Hochschild Mining PLC and Toronto-listed copper miner First Quantum Minerals Ltd. announced they would hedge some of their production to lock in prices. But prices of most metals have since tumbled. In recent weeks, London-listed silver miner Hochschild Mining PLC and Toronto-listed copper miner First Quantum Minerals Ltd. announced they would hedge some of their production to lock in prices.

Both moves came as a mild surprise.

"Hedging became such a no-no in the bull market that it nearly disappeared from the lexicon," Citigroup analyst Johan Bergtheil said following First Quantum's announcement.

Hedging, or locking in the future sale price of a commodity, can be a good move if prices fall, but can backfire if prices climb -- a trend that seemed a near-certainty during the 2003-2008 run.

But with prices volatile and looking less likely to climb steadily, more may follow Hochschild and First Quantum's lead.

3. b. (10 points) Use the information in the following article ("Moody's Downgrades Jamaica's Currency Ratings on Bonds," WSJ, March 4)

to discuss the function of ratings agencies in the financial system.

You don't have to restrict yourself to the information in the article. Do not write more than one page.

Moody's Investors Service has cut its foreign- and local-currency ratings on Jamaica's government bonds further into junk territory to reflect "deterioration in the country's fiscal and debt positions" amid the global recession.

The ratings agency cut its foreign-currency and local-currency ratings to B2 from B1 and Ba2, respectively. The latter move was a three-notch downgrade, and B2 is five steps below investment grade. Moody's had put Jamaica's ratings on review for possible downgrade in November because of the growing pressure on its external and fiscal positions.

"While Jamaica's high willingness to pay remains an integral element of its credit profile, the government's finances and the external position are simply too weak to face a shock of this magnitude without a worsening of credit risk," Moody's senior analyst Alessandra Alecci said Wednesday.

The company sees Jamaica's budget deficit approaching 6% of gross domestic product this fiscal year, while the country's current account deficit could remain in the double digits despite falling imports. And because of expected declines in capital inflows around the globe, funding the current-account gap could prove difficult, Moody's said.

Ms. Alecci noted Jamaica's three main foreign-exchange-generating sectors are expected to face significant declines, as tourism and the bauxite-alumina sector face setbacks from the recession and remittances from abroad suffer. She added the weakness is made worse by the public debt's structure, as more than half is exposed to foreign currency.

Both the Jamaican dollar and interest rates are under pressure as investors flock to so-called safe havens. Policy options for dealing with the recession are very limited because interest payments account for almost half of revenue and government spending is relatively inflexible, Ms. Alecci said.

Despite the challenges, Moody's expects the country to avert any situation in which "serious concerns about debt repayment arise." Ms. Alecci noted that policy makers are used to facing situations with high volatility, and the government has a reliable funding source because its debt is held mostly by local institutions.

4. (30 points) Find below the Balance Sheet and Income Statement for Walmart (WMT) as provided by Yahoo (http://finance.yahoo.com/q/is?s=WMT&annual) for the last three years.

(All numbers in thousands.)

- Use the information to compute the Return on Book Value of Equity, Return on Book Value of Assets, Net Profit Margin and Asset Turnover for the years ended 1/31/2008 and 1/31/2007.

- Has there been an improvement in Return on Equity from 2007 to 2008?

- Is this due to operating efficiency, efficient management of assets or financial leverage?

- Using Yahoo data, it is possible to compute ROE for the year ended 2/28/2008 for Target (TGT) as 18.42%; its Net Profit margin is 20.18%, while its Equity Multiplier is 2.91. Using data for 2008 (i.e. financial years ending in Jan. and Feb. respectively for WMT and TGT), how would you compare the strategies of Wal-Mart with Target?

- Has Wal-Mart become more efficient in its use of inventory over the last two years? Why do you say so?

- The number of shares outstanding at the end of the fiscal year ending 31 Jan. 2008 was 4066 million. Estimate the share price as of that date. Would you have any caveats regarding your answer? (That is, are there any cautions that you would give to somebody using your estimated share price?)

| PERIOD ENDING |

31-Jan-08 |

31-Jan-07 |

31-Jan-06 |

|

| Assets |

| Current Assets |

|

Cash And Cash Equivalents |

5,569,000 |

7,373,000 |

6,414,000 |

|

Short Term Investments |

- |

- |

- |

|

Net Receivables |

3,654,000 |

2,840,000 |

2,662,000 |

|

Inventory |

35,180,000 |

33,685,000 |

32,191,000 |

|

Other Current Assets |

3,182,000 |

2,690,000 |

2,557,000 |

|

| Total Current Assets |

47,585,000 |

46,588,000 |

43,824,000 |

| Long Term Investments |

- |

- |

- |

| Property Plant and Equipment |

97,017,000 |

88,440,000 |

79,290,000 |

| Goodwill |

16,071,000 |

13,759,000 |

12,188,000 |

| Intangible Assets |

- |

- |

- |

| Accumulated Amortization |

- |

- |

- |

| Other Assets |

2,841,000 |

2,406,000 |

2,885,000 |

| Deferred Long Term Asset Charges |

- |

- |

- |

|

| Total Assets |

163,514,000 |

151,193,000 |

138,187,000 |

|

| Liabilities |

| Current Liabilities |

|

Accounts Payable |

44,278,000 |

43,471,000 |

40,178,000 |

|

Short/Current Long Term Debt |

11,269,000 |

8,283,000 |

8,648,000 |

|

Other Current Liabilities |

2,907,000 |

- |

- |

|

| Total Current Liabilities |

58,454,000 |

51,754,000 |

48,826,000 |

| Long Term Debt |

33,402,000 |

30,735,000 |

30,171,000 |

| Other Liabilities |

- |

- |

- |

| Deferred Long Term Liability Charges |

5,111,000 |

4,971,000 |

4,552,000 |

| Minority Interest |

1,939,000 |

2,160,000 |

1,467,000 |

| Negative Goodwill |

- |

- |

- |

|

| Total Liabilities |

98,906,000 |

89,620,000 |

85,016,000 |

|

| Stockholders' Equity |

| Misc Stocks Options Warrants |

- |

- |

- |

| Redeemable Preferred Stock |

- |

- |

- |

| Preferred Stock |

- |

- |

- |

| Common Stock |

397,000 |

413,000 |

417,000 |

| Retained Earnings |

57,319,000 |

55,818,000 |

49,105,000 |

| Treasury Stock |

- |

- |

- |

| Capital Surplus |

3,028,000 |

2,834,000 |

2,596,000 |

| Other Stockholder Equity |

3,864,000 |

2,508,000 |

1,053,000 |

|

| Total Stockholder Equity |

64,608,000 |

61,573,000 |

53,171,000 |

| PERIOD ENDING |

31-Jan-08 |

31-Jan-07 |

31-Jan-06 |

| Total Revenue |

378,799,000 |

348,650,000 |

315,654,000 |

| Cost of Revenue |

286,515,000 |

264,152,000 |

240,391,000 |

|

| Gross Profit |

92,284,000 |

84,498,000 |

75,263,000 |

|

|

Operating Expenses |

|

Research Development |

- |

- |

- |

|

Selling General and Administrative |

70,288,000 |

64,001,000 |

56,733,000 |

|

Non Recurring |

- |

- |

- |

|

Others |

- |

- |

- |

|

|

|

Total Operating Expenses |

- |

- |

- |

|

|

| Operating Income or Loss |

21,996,000 |

20,497,000 |

18,530,000 |

|

|

Income from Continuing Operations |

|

Total Other Income/Expenses Net |

305,000 |

280,000 |

248,000 |

|

Earnings Before Interest And Taxes |

22,301,000 |

20,777,000 |

18,778,000 |

|

Interest Expense |

2,103,000 |

1,809,000 |

1,420,000 |

|

Income Before Tax |

20,198,000 |

18,968,000 |

17,358,000 |

|

Income Tax Expense |

6,908,000 |

6,365,000 |

5,803,000 |

|

Minority Interest |

(406,000) |

(425,000) |

(324,000) |

|

|

|

Net Income From Continuing Ops |

12,884,000 |

12,178,000 |

11,231,000 |

|

|

Non-recurring Events |

|

Discontinued Operations |

(153,000) |

(894,000) |

- |

|

Extraordinary Items |

- |

- |

- |

|

Effect Of Accounting Changes |

- |

- |

- |

|

Other Items |

- |

- |

- |

|

|

| Net Income |

12,731,000 |

11,284,000 |

11,231,000 |

5. Answer the following questions:

- (5 points) You invest $255 at the beginning of 2003. At the end of 2006, it has grown to $299.43. What is your annual rate of return over the three year period?

- (5 points) Suppose you want to buy a house in 3 years; you estimate that the house will cost $125000 at that time. If you know that your investments will yield 12% p.a. over the next year and 14.5% over years two and three, how much do you need to invest today to make sure that you will have enough money to buy your house?

- (5 points) You use the answer from part (b) to decide how much to invest today. However, your investments over the next year yield only 10%. If you are to be able to buy your house, what must be the return on your money over years two and three?

- (5 points) You believe that the rate of return on investments is 12% a year. If you invest $200 a month for the next 5 years, how much will you have at the end of the period?

- (10 points) You want to buy a house costing $200,000; you have approached a bank for a mortgage on monthly repayment terms. If the bank's alternative is to lend the money to a businessman who promises to pay interest at the rate of 12% a year, what APR should it charge you? If it does charge you that rate, what would your monthly payment be?

Midterm Solution

1. As explained, the way P/E ratios are used to price stock is as follows: Suppose an analyst wants to price a stock earning $4.30 per share. He looks at a set of other stocks thats are similar to the stock in question; he finds that the average P/E ratio for that set of comparison stocks is 15.30. Using this, he estimates the price of his stock as 15.30($4.30) = $65.79.

In order for this technique to work the P/E should be a good estimate of the price of one dollar of earnings. According to Geffen, valuations these days are subjective. In other words, the price per dollar of earnings is not something solid based on objective criteria. It is very volatile. Hence it's best not to use P/Es for pricing. Furthermore, earnings expectations are also constantly changing. In short, both earnings estimates and the price per dollar of earnings is unreliable.

2.

- If the firm goes into bankruptcy, then the explicit costs of bankruptcy, such as legal costs etc. would have to be borne by stockholders and bondholders jointly. By negotiating outside bankruptcy court, these costs can be saved.

- Bondholders should provide more flexibility to GGP so as to reduce the probability of bankruptcy, for example, by reducing current interest payments or even foregoing them altogether, or perhaps by increasing the maturity of the bonds. However, they should try and get higher interest payments in future or an increased principal repayment when the bonds mature. In this way, they would keep the present value of the bonds intact, as well as avoiding bankruptcy costs.

- If GGP continues without negotiating with bondholders, it would be pushed into bankruptcy, which would entail bankruptcy costs. On the other hand, if the firm does go into bankruptcy, it might have more leverage with bondholders. Thus, there is a trade-off for GGP. The best thing for GGP's shareholders would be to extract as many concessions as possible from its bondholders while not actually going into bankruptcy.

3.

- Futures markets allow producers to hedge the prices that they can get in the future. This will allow them to avoid the uncertainty of future revenues. They also allow information from different traders to be aggregated.

- The function of ratings agencies is to provide information to bondholders in the financial markets. Thus, in the case of Jamaica, the deterioration in the country's fiscal and debt positions is reflected in a lower debt rating. Often, however, bond markets price in this information even ahead of the ratings changes, calling into question the informativeness of bond ratings.

4. a.

| |

1/31/2008 |

1/31/2007 |

| Average Bk Val of Equity |

(64608000+61573000)/2

= 63090500 |

(61573000+53171000)/2

= 57372000 |

| Average Bk Val of Assets |

(163514000+151193000)/2

= 157353500 |

(151193000+138187000)/2

= 144690000 |

| Return on Bk Val of Equity |

12731000/63090500

= 20.18% |

11284000/57372000

= 19.67% |

| Return on Bk Val of Assets |

12731000/157353500

= 8.09% |

11284000/144690000

=7.80% |

| Net Profit Margin |

12731000/378799000

= 3.36% |

11284000/348650000

= 3.24% |

| Asset Turnover |

378799000/157353500

= 2.4073 |

348650000/144690000

= 2.4096 |

| Equity Multiplier |

163514000/64608000

= 2.5309 |

151193000/61573000

= 2.4555 |

| Average Inventory |

(35180000+33685000)/2

= 34432500 |

(33685000+32191000)/2

= 32938000 |

| COGS/Avg Inventory |

286515000/34432500

= 8.3211 |

264152000/32938000

= 8.0197 |

b. ROE has increased a bit from 2007 to 2008 -- from 19.67% to 20.18%

c. Net Profit Margin has increased from 3.24% to 3.36% and so has the equity multiplier, while asset turnover has decreased somewhat. Hence the increase in ROE is due to better operating efficiency (i.e. a higher profit margin) as well as due to financial leverage.

d.

| |

TGT |

WMT |

| ROE |

18.42% |

20.18% |

| Net Profit Margin |

20.18% |

3.36% |

| Equity Multiplier |

2.91 |

2.5309 |

Clearly, WMT is focusing on volume over margin, while Target is focusing on high-margin items. They are fairly similar in terms of financial leverage; if anything, Target has greater financial leverage, but WMT still has a higher ROE. Hence, its ROA must be even higher compared to Target.

e. Comparing values for COGS/Av. Inventory, we see that WMT has become a bit more efficient in its use of inventory.

f. The book value of equity as of 31 Jan. 2009 was 64.608b.; the number of shares outstanding was 4.066b. The estimated price per share would then be 64.608/4.066 = $15.89. This is an estimate of the share price. However, what we actually want is the market value of equity in the numerator. To the extent that the company expects to have higher profits in the future, the current book value of equity would underestimate the market value of equity. This is probably the case with WMT.

5.

- The annual rate of return is (299.43/255)1/4- 1 = 4.097%

- Suppose you invest $C. Then, you need C(1.12)(1.145)2 = 125000; solving, we find C = $85,129.68

- Initial investment is $85,129.68 (from part 2). With a 10% return for the first year, it grows to 85,129.68(1.1) = $93642.65. In order to grow to $125,000, the annual rate of return over the next two years will have to be y%, where 93642.65(1+y)2 = 125,000. Solving, we find y = 15.536%

- The rate of return per month is (1.12)1/12 -1 = 0.0094888. PV(annuity) = (200/0.0094888)[1-(1/1.0.0094888)60] = $9117.56. The future value is 9117.56(1.12)5 = $16068.25

- The APR should be 0.0094888x12 = 11.3866%. Using this APR (or the equivalent interest rate of 0.99488% per month), the monthly payment C should satisfy 200,000 = (C/0.0094888)[1-(1/1.0.0094888)60]. Solving, we find C = $4387.14.

Final Exam

Notes:

- If your answers are not legible or are otherwise difficult to follow, I

reserve the right not to give you any points.

- If you cheat in any way, I reserve the right to give you no points for the

exam, and to give you a failing grade for the course.

- You may bring in sheets with formulas, but no worked-out examples, or definitions,

or anything else.

- You must explain all your answers. For the quantitative questions, you must

show your formulas and your computation, else you may get no credit at all.

- Questions 1, 6 and 7 are compulsory. Of questions 2, 3, 4 and 5, do any three.

1. (10 points) Read the following article by Mark Roe which appeared in the May 1, 2009 issue of the WSJ and discuss two different issues that Prof. Roe brings up that could make a Chrysler bankruptcy long, complicated and costly.

A Chrysler Bankruptcy Won't Be Quick

It will be difficult for a judge to sort through the many conflicting claims.

Yesterday, Chrysler filed for Chapter 11 bankruptcy protection in preparation for a partnership with Italy's Fiat. President Barack Obama says he hopes the bankruptcy proceeding will be quick and efficient, and that the Fiat deal "will give Chrysler a chance not only to survive, but to thrive in a global auto industry."

I hope so too. But a Chrysler bankruptcy has many moving parts -- and with Chrysler unable to make money selling cars, it just doesn't have enough nongovernment cash to grease those moving parts to facilitate a smooth bankruptcy. Chrysler is in worse shape than GM. And remember, Fiat has yet to offer a penny for its 20% share in Chrysler. Thus far, it's only offering access to its fuel-efficient technology.

This could get messy. First off, in a bankruptcy any single creditor is entitled to get the liquidation value of its claim. So any creditor can assert that what it would get if Chrysler sold its factories quickly would be more than the 32 cents per dollar that Treasury had guaranteed Chrysler's secured creditors before the government deal fell apart this week.

Valuation proceedings are notoriously difficult in Chapter 11. Although the judge doesn't actually need to liquidate Chrysler, the judge must determine what it would have gone for if there were a liquidation. Some creditors appeared ready to bring that case to the bankruptcy judge.

On top of liquidation value, the whole class of secured creditors is entitled to the "fair value" of their claims. Usually fair value -- the money that can be obtained from operations -- is greater than liquidation value, though Chrysler may be an exception.

The government thinks the fair value issue will be resolved easily. That's because in a bankruptcy proceeding the creditors whose claims amount to two-thirds of the total amount of debt can bind the rest to take the deal. Indeed, the judge doesn't have to figure out whether value is fair, if the class of creditors votes in favor. And since two-thirds have already raised their hands in favor of 32 cents on the dollar, it seems to be a done deal.

But this time it might not be so easy. Not all of those who've already raised their hands in favor prior to bankruptcy, especially the smaller investors, will still be raising their hands inside Chapter 11. They can change their mind, and some just didn't want any negative publicity before the bankruptcy.

Worse, there could be a legal fight over whether the vote of Citibank and the other "big four" creditors -- J.P. Morgan Chase, Morgan Stanley and Goldman Sachs, who together hold 70% of Chrysler's debt -- should be counted toward the two-thirds threshold that would bind the company's other 42 creditors. The Bankruptcy Code requires that the votes of creditors be given in "good faith." It won't be hard for the smaller creditors to argue that Citibank and other TARP recipient's votes aren't in full good faith. In agreeing to Treasury's offer of 32 cents for each $1 of their debt, the objectors would say, Citibank and some others were influenced by the fact that Treasury was keeping them afloat with federal subsidies. If this type of litigation begins, it won't be easily resolved.

Meanwhile, Fiat will want to rationalize Chrysler's bloated dealership network. Indeed, this once seemed a core aspect of any effort to reconstruct Chrysler, so the last day's focus on a few secured creditors seems misplaced. But terminated dealers won't go quietly. They'll argue that their contracts can't be easily rejected by a bankruptcy judge because they're protected by state franchise laws. And in any event, they are entitled to some form of payment (reduced or otherwise) from a bankrupt Chrysler if their dealerships are terminated.

If the bankruptcy court could sell Chrysler's core operations intact, many of these bankruptcy frictions could be left behind. That would be the best operational outcome, but it's not clear that there's any real buyer -- Fiat is prepared to take a major stock position in a reorganized Chrysler, but it doesn't seem ready to pay any cash for it. Sales of divisions of a bankrupt firm are common in bankruptcy and often the best solution. But these kinds of sales typically are done via an auction, where other players can outbid Fiat. If Fiat isn't paying anything, then it may be easy to outbid. The question then would become whether the judge would be willing this time to forego a real auction.

If Chrysler could make cars that more people wanted to buy, bankruptcy would be much easier -- and probably not necessary. But that's not the case, so figuring out who will bear what amount of the losses will take place in a bankruptcy court, where too many players have leverage under the law, and where the reality of Chrysler's weak operational prospects makes a fast and easy resolution unlikely if the company can't be quickly sold.

2. (15 points) You work for a company that makes mats. You have an idea for a new type of mat that is made of a special synthetic material that is easy to wash. You go to your boss and suggest that your company should start making the new mats. Your boss asks you if you have worked out the possible financial outcomes. You show him the following projections for the next four years (in millions of dollars):

| Forecasts |

2010 |

2011 |

2012 |

2013 |

| Revenue |

25 |

28 |

33 |

40 |

| COGS |

20 |

22.4 |

26.4 |

32 |

| SG&A |

2 |

2 |

3 |

4 |

| Depreciation |

2 |

2.24 |

2.64 |

3.2 |

The company's tax rate is 35%. Furthermore, the initial investment (at the end of 2009) required is $5m. In addition, there will be a need for working capital of $1m, which has to be laid out immediately, and which can be recouped at the end of 2013. The new project has the same risk as the company's existing projects. The company's unlevered beta is 1.5, the risk-free rate is 3% and the market risk premium is 8%. Should you go ahead with this project?

3. You have the following data on end-of-day prices for Ford stock on the NYSE from Yahoo.

| Date |

Close |

| 5/1/2009 |

5.88 |

| 4/1/2009 |

5.98 |

| 3/2/2009 |

2.63 |

| 2/2/2009 |

2 |

| 1/2/2009 |

1.87 |

| 12/1/2008 |

2.29 |

| 11/3/2008 |

2.69 |

| 10/1/2008 |

2.19 |

| 9/3/2008 |

5.2 |

- (3 points) Using this information, what is your estimate of the expected monthly return on Ford?

- (4 points) What is your estimate of the standard deviation?

- (5 points) How confident are you about your estimate of the expected monthly return?

- (3 points) If you used your results to predict the stock price for June 1, 2009, what would that prediction be?

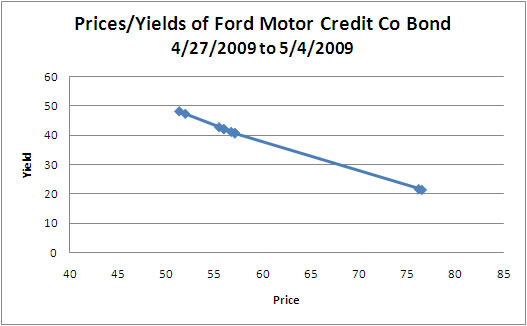

4. The following question is based on data obtained from http://www.finra.org. Ford Motor Credit Company has a bond maturing on Feb. 2, 2011. It has a coupon rate of 5% and last traded at $76.21 on May 4, 2009. It was rated by Moody's on Dec. 22, 2008 as a Caa1 bond. Its face value is $1000 and yield-to-maturity when first issued was 5%. The first coupon was payable on Aug. 20, 2004. You also have the following transactions data on the bond.

| Transactions Data for Ford Motor Credit Co Bond |

| Date |

Quantity |

Price |

Yield |

| 05/04/2009 |

3000 |

76.210 |

21.703 |

| 05/04/2009 |

3000 |

76.543 |

21.423 |

| 04/28/2009 |

15000 |

57.150 |

40.659 |

| 04/28/2009 |

20000 |

57.150 |

40.659 |

| 04/28/2009 |

10000 |

57.150 |

40.659 |

| 04/28/2009 |

45000 |

55.500 |

42.701 |

| 04/28/2009 |

3000 |

56.000 |

42.074 |

| 04/28/2009 |

3000 |

56.015 |

42.055 |

| 04/28/2009 |

3000 |

56.765 |

41.128 |

| 04/27/2009 |

48000 |

51.375 |

48.105 |

| 04/27/2009 |

48000 |

52.000 |

47.241 |

|

|

Answer the following questions:

- (2 points) At what price was the bond issued?

- (3 points) Your friend Natalie says: "The coupon rate is only 5%. There is no way the yield could be as high as 48% or even 21%. The numbers must be incorrect!" Convince her that she is wrong.

- (3 points) The price of the Ford Motor Credit Co. bond rose from $57.15 to $76.54 over the six days from April 28 to May 4. What, do you think, happened to the stock price? Explain.

- (4 points) Use the two prices from April 27 to find the sensitivity of the bond price to changes in the yield. That is, find the percentage change in the bond price for a one-percentage change in the bond yield.

- (3 points) If the bond in question were a Treasury bond, the measure that you computed above would be approximately equal to the negative of the bond maturity. What does this tell you about the investor expectations regarding the chances of actually receiving the bond principal at maturity?

5. Here is some information regarding the dividends paid on common stock of the Ford Motor Company since April 2003 upto the present (May 2009). (No dividends have been paid from July 2006 until today.)

| Date |

Dividends |

Date |

Dividends |

| 7/31/2006 |

0.05 |

1/29/2003 |

0.1 |

| 4/28/2006 |

0.1 |

10/30/2002 |

0.1 |

| 1/26/2006 |

0.1 |

7/31/2002 |

0.1 |

| 10/28/2005 |

0.1 |

5/1/2002 |

0.1 |

| 7/29/2005 |

0.1 |

1/28/2002 |

0.1 |

| 4/28/2005 |

0.1 |

10/31/2001 |

0.15 |

| 1/26/2005 |

0.1 |

8/1/2001 |

0.3 |

| 10/28/2004 |

0.1 |

4/30/2001 |

0.3 |

| 7/28/2004 |

0.1 |

1/26/2001 |

0.3 |

| 4/28/2004 |

0.1 |

10/30/2000 |

0.3 |

| 1/28/2004 |

0.1 |

7/24/2000 |

0.286 |

| 10/29/2003 |

0.1 |

6/29/2000 |

0.997 |

| 7/30/2003 |

0.1 |

4/28/2000 |

0.286 |

| 4/30/2003 |

0.1 |

1/28/2000 |

0.286 |

- (3 points) When you do expect Ford to pay dividends again? Justify your answer.

- (3 points) Assume that Ford's stock dividends will grow at a constant rate from then on. At what permanent growth rate do you think Ford's dividends will grow? Justify your answer.

- (4 points) Here is some more information on the average returns on Ford Motor Company stock:

Average monthly return computed using data upto present starting from |

Average Monthly Return |

2/1/2008 |

0.060169 |

2/1/2007 |

0.029548 |

2/1/2006 |

0.023064 |

2/1/2005 |

0.011762 |

2/2/2004 |

0.009734 |

2/3/2003 |

0.018143 |

2/1/2002 |

0.011688 |

2/1/2001 |

0.00517 |

2/1/2000 |

0.007781 |

According to http://finance.yahoo.com/q/ks?s=F, Ford's equity beta is 2.86. The yield on 1-year Treasury notes is about 1%. The market risk premium has been estimated to be about 7% per annum. Use this information and any other information you may have to come up with an estimate of Ford's current stock price.

- (5 points) Ford's total debt is $154.2b (book value) and it's market capitalization (i.e. market value of equity) is $14.02b. Compute its beta if it were not levered (this is called the asset beta).

6. (30 points) Answer any six of the following questions. Use no more than one page for each question:

- What are agency costs? What are the agency costs of debt?

- Consider the following set of industries and rank them in order of their market beta magnitudes. Explain:

- Food Processing

- Semiconductors

- Auto and Truck Manufacturers

- Electric Utilities

- Stock prices typically rise when the firm makes an announcement of a new product. Why should this be so, according to the Efficient Market Hypothesis?

- When stocks go ex-dividend, the stock price drops. Why don't we see this happening with bonds when the coupon is paid?

- Why can the IRR method not always be used when choosing between mutually exclusive projects?

- Sasha goes to his boss and suggests using a currently unused floor of the company's building to operate a new venture. His boss imputes a cost for the use of the unused space and finds that Sasha's project is unprofitable. Sasha objects and says that the floor is not being used anyway -- hence the implicit cost assigned to the space should be zero! What do you think?

- Interest payments are deductible for corporate tax purposes. Hence, one would think that debt should increase the value of a firm. However, your friend is convinced that if all taxes are taken into account, debt could actually decrease the value of a firm. How could this be?

- Why is an asset's idiosyncratic risk irrelevant for determination of that's asset's market price?

7. (15 points) Read the following article by Jackie Cheung from the WSJ of May 6 and asnwer this question:

Your friend, Chao Li, tells you:

Prof. PV taught us in class that issuing equity does not dilute earnings and should not cause the stock price to drop. Well, fat lot he knows. I just read in the WSJ of May 6th that the shares of Li and Fung, a Hong Kong based trading firm, dropped 8.1% after they issued new shares. And, in fact, the article reports that the share sale is going to dilute the company's forecasted per-share earnings by 3.5%, according to UBS. Well, this is the last time I am going to get taken in by anything he says!

Can you convince Chao Li that Prof PV could still be right; that the article does not necessarily disprove him? Alternatively, if you agree with Chao Li, explain why the article contradicts Prof. PV's so-called demonstration.

Li & Fung Sells Shares at Bottom of Price Range

HONG KONG -- Shares of Li & Fung Ltd. tumbled 8.1% Tuesday after the consumer goods exporter sold 2.68 billion Hong Kong dollars (US$344 million) worth of new shares at the bottom of the indicative price range.

Analysts said the placement came as a surprise to the market, because the blue-chip company had raised US$500 million in September. Li & Fung said it would use the proceeds from the placement to finance acquisitions and expansion.

Ratings agency Moody's Investors Service said late Tuesday that the share placement "will further strengthen Li & Fung's existing liquidity position and equity base and is consistent with the company's prudent financial management."

Li & Fung ended Tuesday's session at HK$22.05, while the Hang Seng Index was up 0.3% at 16430. Between April 28 and Monday, the stock had jumped 22% amid optimism that the U.S. consumer market would recover and the company would make further acquisitions and land more outsourcing deals.

UBS said in a note that the share sale would dilute the company's forecast 2009 per-share earnings by 3.5%.

Li & Fung said it placed 120.3 million shares at HK$22.55 each, a 6% discount to its Monday closing of HK$24.00. The shares were sold at the low end of a HK$22.55-HK$23.28 price range, according to a term sheet seen by Dow Jones Newswires on Monday.

The placement "can either be seen as opportunistic protection in a difficult market or a precursor to further significant acquisitions," said CLSA analyst Robert Bruce in a report.

Li & Fung can benefit from increasing scale in the beauty and cosmetics segment, Mr. Bruce said.

Daiwa Research analyst Peter Chu said in a note that the company's net gearing will fall sharply following the latest placement.

The company now has a war chest of about HK$4 billion with which to make acquisitions, Mr. Chu said.

Some analysts expect further profit-taking in Li & Fung's stock. UBS said any potential outsourcing deals the company may sign have been fully factored into the stock's recent rally and advised investors to "sell into any strength."

For 2008, Li & Fung's net profit fell 21% to HK$2.42 billion because of weak consumer sentiment amid the global economic downturn and one-off restructuring costs in its U.S. business.

The company has said it is on track to achieve its US$20 billion annual revenue target in 2010, compared with HK$110.72 billion in 2008, primarily through increasing outsourcing deals and acquisitions.

Final Solutions

1.

Prof. Mark Roe brings up the following issues:

- "In a bankruptcy any single creditor is entitled to get the liquidation value of its claim. So any creditor can assert that what it would get if Chrysler sold its factories quickly would be more than the 32 cents per dollar that Treasury had guaranteed Chrysler's secured creditors before the government deal fell apart this week." Establishing the liquidation value can be difficult whether or not Chrysler is liquidated. "Although the judge doesn't actually need to liquidate Chrysler, the judge must determine what it would have gone for if there were a liquidation. Some creditors appeared ready to bring that case to the bankruptcy judge."

- "The whole class of secured creditors is entitled to the "fair value" of their claims. Usually fair value -- the money that can be obtained from operations -- is greater than liquidation value, though Chrysler may be an exception.

The government thinks the fair value issue will be resolved easily. That's because in a bankruptcy proceeding the creditors whose claims amount to two-thirds of the total amount of debt can bind the rest to take the deal. Indeed, the judge doesn't have to figure out whether value is fair, if the class of creditors votes in favor. And since two-thirds have already raised their hands in favor of 32 cents on the dollar, it seems to be a done deal.

But this time it might not be so easy. Not all of those who've already raised their hands in favor prior to bankruptcy, especially the smaller investors, will still be raising their hands inside Chapter 11. They can change their mind, and some just didn't want any negative publicity before the bankruptcy."

- "There could be a legal fight over whether the vote of Citibank and the other "big four" creditors -- J.P. Morgan Chase, Morgan Stanley and Goldman Sachs, who together hold 70% of Chrysler's debt -- should be counted toward the two-thirds threshold that would bind the company's other 42 creditors. The Bankruptcy Code requires that the votes of creditors be given in "good faith." It won't be hard for the smaller creditors to argue that Citibank and other TARP recipient's votes aren't in full good faith. In agreeing to Treasury's offer of 32 cents for each $1 of their debt, the objectors would say, Citibank and some others were influenced by the fact that Treasury was keeping them afloat with federal subsidies. If this type of litigation begins, it won't be easily resolved."

- "Fiat will want to rationalize Chrysler's bloated dealership network. Indeed, this once seemed a core aspect of any effort to reconstruct Chrysler, so the last day's focus on a few secured creditors seems misplaced. But terminated dealers won't go quietly. They'll argue that their contracts can't be easily rejected by a bankruptcy judge because they're protected by state franchise laws. And in any event, they are entitled to some form of payment (reduced or otherwise) from a bankrupt Chrysler if their dealerships are terminated."

- "If Chrysler could make cars that more people wanted to buy, bankruptcy would be much easier -- and probably not necessary. But that's not the case, so figuring out who will bear what amount of the losses will take place in a bankruptcy court, where too many players have leverage under the law, and where the reality of Chrysler's weak operational prospects makes a fast and easy resolution unlikely if the company can't be quickly sold."

2.

We first compute Taxable Income as Revenue less COGS less SG&A less Depreciation; we then multiply it by (1-tax rate) to get Unlevered Income. (The implicit assumption is that Depreciation is not included in COGS or in SG&A.) We then add back Depreciation to get Free Cash Flow (FCF).

|

2010 |

2011 |

2012 |

2013 |

| Revenue |

25 |

28 |

33 |

40 |

| COGS |

20 |

22.4 |

26.4 |

32 |

| SG&A |

2 |

2 |

3 |

4 |

| Depreciation |

2 |

2.24 |

2.64 |

3.2 |

| EBIT |

1 |

1.36 |

0.96 |

0.8 |

| Taxes |

0.35 |

0.476 |

0.336 |

0.28 |

| Unlevered Income |

0.65 |

0.884 |

0.624 |

0.52 |

| FCF |

2.65 |

3.124 |

3.264 |

3.72 |

| Present Value |

2.30435 |

2.362 |

2.146 |

2.127 |

The required rate of return is computed using the CAPM as 3 + 1.5(8) = 15%

The last line of the table computes the present value of the FCF each year using the 15% discount rate. Adding them up, we get $12.412 million. However, we need to subtract from this, the initial investment requirements of $5m plus $1m for working capital, which gives us $8.94-$6 = $2.94. To this, we add the present value of the working capital that can be recovered at the end of 2013, 1/(1.15)4, or $0.5718m. This gives us a NPV of $3.511m.

Note: Don't ask me how an initial investment of $5m. allows for a total depreciation of $12.24 over the four years! IRS accounting rules :-)

3.

- The closing prices can be used to compute returns as in column 3, as Pt/Pt-1-1. The average return is then computed as 0.119865 or 11.9865%

- Column 4 contains the deviations of the returns each month from this mean. The last column is the square of these deviations. The variance of the underlying distribution is then computed as the sum of these squared deviations divided by 7, which is the number of observations less 1. This estimated variance works out to 0.2935 and the square root of the estimated variance constitutes an estimate of the standard deviation, which is 0.5418 or 54.18%

- My confidence regarding the estimate can be expressed in terms of the 95% confidence interval for the mean. For this, I need to know the standard error of the mean, which is the standard deviation divided by the square root of 8, i.e. 0.5418/√8

= 0.1916. The 95% confidence interval, then, is 0.119865

±

1.96(1.1916) = (-0.2556,0.4953). I can then say that the true underlying mean is within this range with a probability of 95%.

- My prediction would be 5.88(1.119865) = $6.5848. (5.88 is the price on May 1, and 11.98% is the average monthly return.

Date |

Close |

Return |

Deviation |

Sq Dev |

| 5/1/2009 |

5.88 |

-0.01672 |

-0.13659 |

0.018656 |

| 4/1/2009 |

5.98 |

1.273764 |

1.153899 |

1.331484 |

| 3/2/2009 |

2.63 |

0.315 |

0.195135 |

0.038078 |

| 2/2/2009 |

2 |

0.069519 |

-0.05035 |

0.002535 |

| 1/2/2009 |

1.87 |

-0.18341 |

-0.30327 |

0.091973 |

| 12/1/2008 |

2.29 |

-0.1487 |

-0.26856 |

0.072127 |

| 11/3/2008 |

2.69 |

0.228311 |

0.108446 |

0.01176 |

| 10/1/2008 |

2.19 |

-0.57885 |

-0.69871 |

0.488197 |

| 9/3/2008 |

5.2 |

|

|

|

4.

- Since the yield-to-maturity of the bond when it was first issued was the same as its coupon rate, the price at issue must have been par, i.e. $1000.

- The yield increases as the price drops because the yield is the yield-to-maturity, i.e. the annual return that would be obtained if the bond were held to maturity and all the promised payments were made. If the bond price drops to almost half of its issue price, as happenned on 4/27, the yield would soar to almost 48%, as shown in the table. Of course, the likelihood of actually getting the 47% is not very high!

- The bond price rose over the six days presumably because the likelihood of the bond being paid off rose. This must have been due to good news about the stock and hence the stock price would have risen as well.

- The bond's price sensitivity to yield can be computed as [(51.375-52)/52]/[(48.105-47.241)/47.241] = -0.65718. This is a measure of what is known as the duration of the bond, i.e. the remaining bond maturity adjusted for the timing of the cashflows on the bond. Even though there are almost 2 years left before the bond matures, there are intermediate cashflows at different points in time.

- The duration is the weighted average of the time to these different cashflows with weights equal to the proportion of the price obtained at the different points, where the yield is used to compute present values of the cashflows. With such high discount rates, the weight of the final payment is much lower than it would be, otherwise. The very low duration of the Ford bond, compared to its maturity suggests that its "duration" would be much shorter -- that is, the final payment is suspect.

5.

- We would need to make some kind of prediction as to when Ford would return to profitability -- perhaps in another four years or May 2013.

- The predicted rate of growth would be equal to the predicted ROE times the predicted retention ratio. Retention ratios will have to be high, perhaps 40%, and the ROE, maybe on the order of 12% leading to a growth rate estimate of 4.8%

- Using the information given, the required rate of return according to the CAPM would be 1% + 2.86(7) = 21%. Assuming that Ford will resume paying a dividend at that point of $1.2 per year (which is about the average in 2004), this gives us a stock price for Ford, as of May 2012 as 1.2/(0.21-0.048) = $7.4. Discounting this back to the present, we get 7.4/(1.21)3= $4.18.

- It's unlevered beta can be computed as βlevered[E/(E+D)], assuming that the beta of debt is zero. This gives us an unlevered beta of 2.86(14.02/(154.2+14.02)] = 0.23836.

6.

- Agency costs

arise whenever you hire someone else to do something for you; your interests(as the principal) may deviate from those of the person you hired (as the agent). Hence the agent may take actions that are suboptimal and inefficient and may lead to opportunity costs. Furthermore, to prevent this, the principal will be obliged to spend resources to monitor the agent. These are also unproductive expenditures caused solely because of the agency problem. Agency costs are the sum of these opportunity costs plus the unproductive out-of-pocket costs.

Agency costs of debt arise because stockholders acting on behalf of bondholders may take excessive risk and may also invest insufficiently in the business. Bondholders impose costs in the form of restrictions called covenants on the stockholders.

- Electric Utilities will have the lowest beta because they are regulated monopolies with relative stable cashflows.

Food Processing is probably the next lowest -- food is a staple and demand will not fluctuate that much.

Autos are more of a luxury and the betas of auto and truck manufacturers will be higher.

Betas of Semiconductor firms will be highest because demand for them is a derived demand -- when the economy turns up, the demand for intermediate goods such as semiconductors will shoot up.

- When a firm makes an announcement of a new product, it usually indicates that the firms profits will rise. Hence, according to the Efficient Markets Hypothesis, the market takes this into account and causes the price to rise.

- This is because the bond price is quoted net of coupon. The "dirty" price, which is inclusive of coupon will drop.

- This is because the projects could differ in scale. A project that is smaller might end up with a lower NPV even if its IRR is higher. The projects could also differ in duration; again, a short duration project with a high IRR could end up having a low NPV.

- Sasha is wrong -- the floor space should be assigned a cost because it could be rented out. If it's not being rented out, then that's a mistake; alternatively, it may be kept vacant to allow for its use in new projects. If so, the firm believes its value as a "real" option is greater than the dollar return from renting it out.

- This is because there are other costs related to debt. For example, as the amount of debt increases, the probability of bankruptcy rises and the expected bankruptcy costs go up. Similarly agency costs of debt rise, as well.

- This is because idiosyncratic risk can be diversified away and doesn't have to be borne by the investor.

7.

The article does not necessarily contradict Prof. PV. First of all, the stock price had previously already factored in the value of any potential acquisitions, as mentioned in the article (that the stock had jumped 22%). The new stock issue would have the impact of reducing the firm's leverage (Peter Chu said the net gearing would fall sharplyl), which might be seen as too low by the market. Also, the very low price at which the new equity was placed provides new -- and negative -- information regarding the value of the stock. Finally, the company had raised US$500 million in September; this may indicate that the company thought that its shares were overvalued and wanted to take advantage of this to sell more stock.

|

|