Lubin School of Business

MBA 648: Managerial Finance

Prof. P.V. Viswanath

Spring 2015

Final

- The exam is closed book.

- Time allowed is 2 hours.

- Explain all your answers; correct answers without explanations may not be given any credit at all.

- Make sure that your answer is clear and concise. Confused and rambling answers will lose points.

- If you answer a question, I have the discretion to award you some points, even if you are completely wrong. If you don't attempt the question at all, I can give you no points! So attempt every question.

1. (40 points) Read the article below from the New York Times of April 16, 2015 and answer the following questions in brief. Rambling answers will get points deducted. No more than one page of your answer booklet for each question.

- The article notes that the Etsy IPO "is also an experiment in corporate governance, a test of whether Wall Street will embrace a company that puts doing social and environmental good on the same pedestal with, if not ahead of, maximizing profits." How could the capping of the amount of stock that can be owned by retail investors help reduce the potential divergence between doing social good and maximizing stockholder welfare?

- "Etsy is one of a growing number of companies, called B Corps, that pledge to adhere to social and environmental accountability guidelines set by a nonprofit organization called B Lab." Why is it necessary to have an outside organization, name B Lab, provide certification that a given company is committed to social and environmental goals? Why can't the company simply undertake to pursue such goals?

- If Etsy as a B-corp wants to take steps like paying all part-time and temporary workers 40 percent above local living wages etcetera, this is likely to make it more difficult for bondholders to get their money back from Etsy, compared to a similar company that put profits first; therefore, bondholders will ask for higher promised returns and thus raise Etsy's cost of capital. Comment.

- According to Yahoo (finance.yahoo.com), "Etsy, Inc. operates online and offline marketplaces to buy and sell handmade items, vintage goods, and craft supplies. Its platform connects sellers and buyers to sell or buy products for art, home and living, mobile accessories, jewelry, wedding, and others." Based on this information, would you expect Etsy to have more debt or less debt than the average firm? Explain your answer.

- Again using the information in d., estimate Etsy's stock beta. Explain your answer.

Etsy I.P.O. Tests Pledge to Balance Social Mission and Profit

The online craft bazaar Etsy made its debut on the Nasdaq stock market Thursday, signaling the birth of an unusual public corporation — and not just because its employees carry around compost on bicycles, or because its regulatory filings are peppered with phrases like, “We keep it real, always.”

Etsy is one of a growing number of companies, called B Corps, that pledge to adhere to social and environmental accountability guidelines set by a nonprofit organization called B Lab. And Etsy on Thursday became only the second for-profit company to go public out of more than 1,000 companies that have that certification.

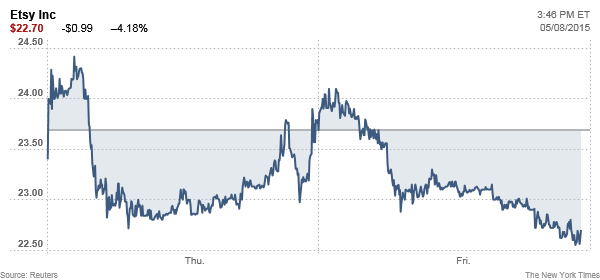

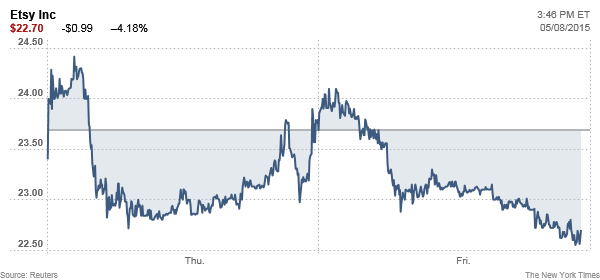

Etsy shares closed on Thursday at $30, almost twice their initial public offering price, in one of the most closely watched market debuts this year.

Ringing the opening bell at Nasdaq’s headquarters in Times Square, amid cheers and confetti and Etsy ads flashing on the screens outside, Etsy’s chief executive, Chad Dickerson, called the debut “an important milestone.” Selected Etsy vendors held a bazaar of their wares in one corner of the square, including a Brooklyn-based vintage clothes seller, an Israeli jewelry designer and a Somerset, Mass., store that sells superhero capes for children.

Overnight, Etsy priced its public offering at $16 a share, at the top end of the company’s proposed range, valuing the company at $1.78 billion. And in a nod to its small-business roots, it capped the amount of stock retail investors had access to in the offering to $2,500, to get as many individuals as possible to participate, including its vendors.

“The success of our business model is based on the success of our sellers,” Mr. Dickerson said in an interview. “That means we don’t have to make a choice between people and profit.”

Etsy’s initial public offering is indeed a milestone for a quirky online marketplace born a decade ago in a Brooklyn loft as a way for one of its founders to peddle handmade wooden goods.

It is also an experiment in corporate governance, a test of whether Wall Street will embrace a company that puts doing social and environmental good on the same pedestal with, if not ahead of, maximizing profits.

Etsy declares in its public offering prospectus that it wants to change the decades-old conventional retail model of valuing profits over community. It states that its reputation depends on maintaining its B Corp status by continuing to offer employees stock options and paid time for volunteering, paying all part-time and temporary workers 40 percent above local living wages, teaching local women and minorities programming skills, and composting its food waste.

And though Etsy has become a significant business, with sales jumping 56 percent last year from the previous year to $195.6 million, it still booked a loss of $15 million. Etsy said that at the end of 2014, the site had 19.8 million active buyers, or shoppers that made at least one purchase in the previous 12 months.

If Etsy eventually reincorporates as a full-fledged benefit corporation, as required to do under B Lab rules, it could potentially become vulnerable to lawsuits from shareholders over any failure to achieve its social mission, in addition to the risk of potential litigation by shareholders over its fiduciary duties.

Still, “B Corps are reaching a tipping point in market acceptance,” said Jay Coen Gilbert, co-founder of B Lab, which assesses and certifies companies along social and environmental accountability standards. “The current shareholder model doesn’t meet the needs of entrepreneurs, business leaders and investors who want to make money and make a difference.”

Depending on whom you ask, B Corp companies like Etsy are a panacea to the ills of shareholder capitalism, a sure money-losing proposition or a tricky and untested scheme that opens a legal can of worms.

Etsy is giving small business owners, like the woodworkers Shelli and Seth Worley of South Carolina, the opportunity to sell to retailers through a wholesale website.

The movement itself grew out of a basketball apparel start-up that Mr. Gilbert helped found in the early 1990s, making sure its suppliers paid their workers fair wages and donating as much as 10 percent of corporate profits to charity. But after selling the company in 2005, Mr. Gilbert and his team found that its new owners swiftly swept aside the company’s social endeavors. Haunted by that experience, the team set out to devise a system that could allow a company to formally commit to social and environmental goals.

B Lab has certified more than 1,000 companies in the United States as B Corps, including Patagonia, Warby Parker and Method. In addition, 27 states have adopted laws that can award companies status as “public benefit corporations,” letting them emphasize social or environmental concerns over profits, and more than a dozen others have introduced similar legislation.

“If you look at the history of American business, I would say that’s how we started,” said Leslie A. Keil, a partner at Hanson Bridgett, law firm in San Francisco that has been a leading proponent of the B Corp movement. “But somewhere along the way, it became just about the bottom line, what your dividends are to shareholders, and what executives are taking home, rather than building a long-lasting business that enriches the community.”

Adam Lowry, chief of Method, which makes natural soaps, said that his company’s experience showed that returns and sustainability were not necessarily at odds. Method decided to power its new factory in Chicago, for example, with a 240-foot windmill and three large solar arrays, despite the presence of cheap, coal-fired energy from the local utility.

“If our only mandate was the cheapest costs now, we’d have made a decision to use coal-fired energy,” he said. “But climate change is the biggest environmental challenge we face, and financially, in seven to eight years, we’re going to be in a much better position because we’ll be getting cheaper energy.”

Most B Corp companies, including Method, have opted to stay private. As a public company, however, Etsy is expected to face scrutiny from investors on how much it prioritizes its noble pursuits over its bottom line. And though Etsy is likely to attract investors with a taste for sustainable investing, there is a lesser-known twist that investors are being warned to heed.

Under B Lab rules, companies incorporated in states with benefit corporation laws must eventually comply with their home states’ standards to maintain that benefit corporation status.

In Delaware, where Etsy is incorporated, even small shareholders of a public benefit corporation could sue the company, claiming it had failed to fulfill its social or environmental duties.

B Lab is giving companies four years from the date any relevant state legislation is passed to comply with the state law or risk losing B Corp certification. Since Delaware passed that law in August 2013, Etsy has until 2017 to become a benefit corporation.

“Etsy could be subject to challenges both from those who think there are not enough social objectives being fulfilled, and for those who think there are too many being fulfilled,” said Philip W. Peters, a business partner at the law firm Farella Braun & Martel.

Mr. Dickerson said that, for now, Etsy had no plans to transition to a benefit corporation. “Regardless of certification, we plan to focus on delivering a strong business that also generates social good,” he said.

The idea of companies taking on societal missions raises other intriguing concerns.

B Corp legislation could allow companies to adopt values some would find objectionable and discriminatory, like religious beliefs, said Kent Greenfield, a professor at Boston College Law School. The Supreme Court justice Samuel A. Alito Jr., in his argument for last year’s Hobby Lobby ruling, cites B Corps as evidence that corporations can be religious.

“If you let companies opt in to their own set of obligations, there’s no constraint from them opting in to their view of ethics as something from the Old Testament,” Mr. Greenfield said.

He also warned that an opt-in system like B Corp’s could divert attention from the need to strengthen corporate governance laws that apply to all firms.

Edward E. Lawler III, a business professor at the University of Southern California, said that regardless of whether the B Corp movement took off, Etsy’s offering had helped raise crucial questions about shareholder value.

“There’s a realization that corporations don’t actually have to put short-term shareholder gain above all else,” he said. “More people are saying: ‘We have a right to ask more of our corporations, and they should not exist simply to generate profit.’ ”

2. The last four years of returns for a stock are as follows:

| Year |

Return |

| 1 |

-4% |

| 2 |

28% |

| 3 |

12% |

| 4 |

4% |

- (4 points) If you believe that the future returns for this stock are likely to be similar in a probabilistic sense, use this information to estimate the expected return on this stock for hte next year.

- (4 points) Estimate the standard deviation of returns on this stock for the next year.

- (8 points) You discover that the research assistant working on this estimation project with you has fudged the return for years 1 and 4 in equal but opposite ways so that the estimated expected return is not affected, but the actual estimate of standard deviation is twice as large as what you computed in part b. What is the true return in years 1 and 4. I will accept either the actual number or a ball-park estimate along with a statement that it is either an upper-limit or a lower-limit. That is, for each of years 1 and 4, give me either an upper-limit estimate or a lower-limit estimate.

3. Procter and Gamble will pay an annual dividend of $0.65 one year from now. Analysts expect this dividend to grow at 12% per year thereafter until the fifth year. Aften then, growth will level off at 2% per year. You have the following additional information. The rate of return on short-term Treasuries for the foreseeable future is 2% per annum. The market risk premium is expected to be 6% for the foreseeable future. P&G's stock is estimated to be 1.5 for the next five years, following which you believe the beta will drop to 0.83333 consistent with its low growth character. You also believe that the CAPM is a good model to use to describe returns expected by investors on financial securities.

- (4 points) What is the required rate of return on P&G stock?

- (8 points) According to the dividend-discount model, what is the value of a share of Procter and Gamble stock?

Note: Betas can indeed change in a predictable fashion over time. However, the reason given in the problem for the betas changing was the change in business model. If so, the betas should have changed gradually, not jumped from 1.5 to 0.8333. This is because at the present, the business consists of two components -- one, the growing firm from now to year 5 and two, the steady firm from year five onwards. if a beta of 1.5 is consistent with the riskiness of the growing firm, the current beta of the whole firm should be a weighted average of 1.5 and 0.8333 where the weights would depend on the relative importance of the growing part and the steady part. This number (which would be less than 1.5 would slowly drop to 0.8333). The answer given, nevertheless, assumes a jump in betas -- it would be a much more tedious computation to assume betas changing gradually.

4. Hajaj Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $2m. and which it currently rents out for $240,000 per year. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an up-front investment into machines and other equipment of $1.4m. This investment can be fully depreciated straight-line over the next ten years for tax purposes. However, Hajaj Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $500,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales, which is not expected to change over the life of the project. Sales of protein bars are expected to be $4.8m. in hte first year and to stay constant for eight years. Total manufacturing costs and operating expenses (excluding depreciation) are 80% of sales, and profits are taxed at 30%.

- (10 points) What are the free cashflows of the project?

- (8 points) Hajaj's cost of debt is 6%, its cost of equity is 12%, its marginal tax rate is 40% and its target debt-equity ratio for this project is 1. What is the NPV of the project?

5. (24 points) Answer any four of the following questions:

- A corporate bond, paying semi-annual coupons and selling at par has a 6% coupon rate. What is the promised effective annual rate of return on the bond?

- Bond prices, in general, will rise over time as they approach maturity. When will this statement be true?

- When stocks go ex-dividend, the stock price drops. Why don't we see this happening with bonds when the coupon is paid?

- "Issuance of new equity dilutes earnings. Hence it's bad." Is true or false? Explain.

- Your friend suggests the following formula to price a stock -- [PV(future free cashflows to the firm) + Cash - Market Value of Debt]/(No. of Shares Outstanding). Argue against this formula.

Final Solutions

1.

- Capping the amount of stock that can be owned by one investor means that there will be a lot of small investors. If we can assume that small retail investors will invest in such as declared B-corp only if they are in alignment with the company's social goals, then such a cap will mean less divergence between doing social good and maximizing stockholder welfare, narrowly defined. The implied assumption is that large retail investors may try to buy control and then change the social strategy of the company from inside, leading to conflict. However, it seems that there are no restrictions on institutional investors, who are much more likely to engage in control-seeking activities. Hence this entire strategy seems suspect.

- This is for the same reason that we have outside accounting auditors. Since the company cannot make all its operations entirely public for competitive reasons, there must be an outside agency with access to relevant but sensitive company information to certify that the company is pursuing social goals.

- This may very well be true if the investors buying the company's stock are profit-oriented; on the other hand, they may also be social goal-oriented. Furthermore, the company's cost of equity may be lower because equity investors are willing to trade off social good for dollar returns.

- Etsy, according to this description is unlikely to have much collateralizable assets. Hence its capital structure is likely to be more tilted towards equity. It is also likely to depend upon growth and be volatile because of the uncertain nature of these new markets; the high volatility is another reason why bond investors may ask for a high rate of return making them unattractive as a source of capital for Etsy.

- The kind of goods that Etsy plans to sell are probably attractive when consumers have a lot of disposable income. Hence its beta is likely to be greater than one.

2. a., b. Note that to get an estimate of the standard deviation for next year, we add the squared deviations for each year from the mean and then divide by 3, not four!

| Year |

Return |

Devsq |

1 |

-4.00% |

0.0196 |

2 |

28.00% |

0.0324 |

3 |

12.00% |

0.0004 |

4 |

4.00% |

0.0036 |

| mean |

10.00% |

13.66% |

c. Doubling the volatility gets you 27.33%. If we are only going to only change the numbers for years 1 and 4, it would be easiest to make the year 1 number more negative and the year 4 number more positive, since we need higher volatility. If we change the numbers to -8% and +8%, we find that the volatility is 14.79%, which is too small; hence 8 is a lower bound. If we change the numbers to -44% and +44%, we get a volatility of 38.3%, which is too large; hence 44 is an upper bound. Through trial-and-error, we can find the right numbers are -25.3% and +25.3%.

3. Dividends next year are 0.65 per share. Dividends for the next four years (until year 5) will grow at the rate of 12% per annum. Dividends, thus, are $0.65, $0.728, $0.815, $0.913 and $1.023 per share respectively for the next five years. These can be discounted to the present and summed up to yield $2.9811. The discount rate for these dividends would be, using the CAPM, 11% (0.02 + 1.5x0.06). As for future dividends, in year 6, they would be 1.023(1.02) or $1.043; the present value of these future dividends at year-end 5 would be (1.043)/(.07-0.02) = $20.865. This future value has to be discounted to year 0. Since the required rate of return for the first five years is 11%, this discounting should be done using a discount rate of 11%. Computing 20.865/(1.07)5, we get $12.382. Adding this to $2.981, we get a total stock price of $15.3635.

4. Let's consider the particular elements in order of appearance. Use of the existing warehouse involves an opportunity cost of $240000 per year, which should be charged to the project. The original acquisition price is water under the bridge, aka sunk cost and irrelevant. The cost of capital for the project is 12(0.5) + 6(0.5)(1-0.4) = 7.8%. The annuity factor for a discount rate of 7.8% eight years is 5.7905. Hence the present value of the warehouse cost is 240,000(5.7905) = 1,389,723.10. The salvage value is $0.5m. Assuming that the tax rate is 30%, the present value would be 0.5(1-0.3)/(1.078)8 or $0.1919m. As far as working capital is concerned, the net cost is (0.1)(4.8) - (0.1)(4.8)/(1.078)8 or 0.48 - 0.2632 or $0.2168m. The after-tax profits are (4.8)(1-0.8)(1-0.3) or $0.672 per year; to this we add depreciation of (1.4/8)(0.3) = 0.0525m. for a total of $0.7245. Multiplied by the annuity factor of 5.7905, we get a present value of $4.1952. Finally, the up-front cost of the machinery is $1.4m. Adding up all the amounts (-$1.3897+0.1919-0.2168+$4.1952-$1.4m.), we get $1.3806m.

To summarize, we have the following cashflow elements:

- immediate cost of machines of $1.4m.

- immediate working capital outlay of (4.8)(0.1) or $0.48m.

- yearly warehouse cost of $0.24m.

- yearly after-tax profits of (4.8)(1-0.3)(1-0.8) of $0.672m.

- yearly depreciation-related tax savings of (1.4/8)(0.3) = 0.0525m.

- final year after-tax equipment salvage value of 0.5(1-0.3) = $0.35m.

- final year working capital recovery of $0.48m.

One final note, the marginal tax rate of 40% mentioned in part b. should not be different from the tax rate at which profits are taxed. However, this figure would be used by the CFO's office and they might have made a mistake; in any case, we assume that the weighted average of cost of capital of 7.8% that that implies is correct. I have thus used the 40% figure in the computation of the cost of capital and 30% elsewhere.

5.

- If this bond is selling at par, then the six-monthly rate of return is 3%. If so, the effective annual rate of return is 1.032 -1 or 6.09% p.a. The bond yield-to-maturity is, of course, still 6% p.a. Bond yields are expressed in APR fashion.

- This will be true for bonds that are issued at a discount. For bonds issued at a premium, bond prices should fall towards maturity and for bonds that are issued at par, there should be no discernible tendency over time.

- This is because the bond price is always quoted excluding the accumulated coupon. Hence if you buy a bond just before the coupon payment date, you will have to pay the seller the quoted price plus the next coupon. Because of this quoting convention, bond prices do not drop when a coupon is paid, as stock prices do when a dividend is paid.

- Dilution of earnings is a mechanistic outcome of a computation. Thus if new equity is issued and no assumptions are made regarding total earnings, earnings-per-share has to drop since now there will be more shares outstanding after the equity issue. The question is whether the funds raised by the new equity issue will be invested in positive NPV projects; if so, and if we add in the expected earnings from the new investments, the EPS should not drop and there will be no earnings dilution.

- This assumes that cash has no value at all in the generation of future free cashflows. This is not true, in general. Hence the proposed technique will overvalue the stock.