| |

Lubin School of Business

MBA 673: Applying Financial Theory to Strategic Decision Making

Prof. P.V. Viswanath

Fall 2014

Midterm

- The exam is closed book except for one sheet of formulas containing _only_ Dupont Analysis formulas. No worked out examples, nothing else.

- Time allowed is 2 hours.

- Explain all your answers; correct answers without explanations may not be given any credit at all.

- Make sure that your answer is clear and concise. Confused and rambling answers will lose points.

- If you answer a question, I have the discretion to award you some points, even if you are completely wrong. If you don't attempt the question at all, I can give you no points! So attempt every question.

1. (25 points) Read the following article from the website http://barrons.com. Based on the evidence provided in this article, which of the five generic competitive strategies do you think Kroger is following? Provide evidence for your opinion. The more evidence you provide, the more points you will get. No more than one page, however.

Kroger: Beyond the Grocery Aisle

No. 2 food retailer Kroger is trying to break out of mass retail by investing in everything from e-commerce to natural foods. The stock could rise 20%.

By Robin Goldwyn Blumenthal, October 4, 2014

Kroger’s new Markeplace stores are as large as 130,000 square feet and sell much more than just groceries. The aim: to better compete with Wal-Mart.

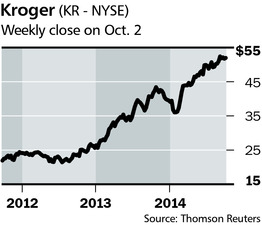

Supermarkets don’t leap to mind when you think of health, wellness, and data-driven technology. But Kroger, the No. 2 U.S. food retailer, with $98 billion in annual revenue, wants to be more than just another mass grocer. While its stock has risen, analysts are seeing room for more upside.

With 2,638 stores operated in 34 states under more than two dozen names, including Fred Meyer, King Soopers, and Smith’s, Kroger (ticker: KR ) is “the only true national grocery chain,” says Greg Dean, a portfolio manager at Cambridge Global Asset Management, which holds the stock. With earnings expected to grow in the high-single to low-double digits, the shares could rise by $10 in the next 12 months—20% above its recent price of $52, says Dean. The stock yields 1.3%.

Morgan Stanley analyst Vincent Sinisi has a $62 price target on the shares, based on an above-average multiple of 17 times on his estimated 2015 earnings of $3.65 a share. Morgan Stanley analyst Vincent Sinisi has a $62 price target on the shares, based on an above-average multiple of 17 times on his estimated 2015 earnings of $3.65 a share.

Kroger boasts 43 consecutive quarters of growth at stores open at least 15 months, impressive in a challenged retail sector. Prior to the latest quarter, market leader Wal-Mart Stores (WMT) has seen same-store sales fall for five quarters.

ALTHOUGH ITS STOCK HAS RISEN, Kroger remains undervalued against many of its peers. Its price/earnings ratio has gone from nine in 2009 to 14 now (based on Wall Street’s consensus earnings estimate of $3.65 a share in 2015), but is still well below Whole Foods Market ’s (WFM) P/E of 22. Kroger thinks it can close that gap by investing in a shopping bag full of innovations.

“On the conventional side of the channel, Kroger is the best example of an unconventional conventional,” says Sinisi, who recently initiated coverage with a Buy rating. What does he mean? For 11 years, Kroger has been using United Kingdom–based dunnhumby to analyze shopping data through its loyalty card—a technique that dunnhumby developed at beleaguered U.K. grocer Tesco (TSCO.UK). The goal: tailor specific coupons to individuals. Dunnhumby says it can analyze “what customers want, where they want it, and how much they’re willing to pay for it.”

Kroger is pushing into e-commerce with a $280 million deal to buy Vitacost.com, a seller of vitamins, supplements, and organic and natural foods, and the $2.5 billion acquisition of Harris Teeter Supermarkets, which has a “click and collect” feature that lets customers buy online and pick up in-store. Kroger’s app is already among the top 2% of apps downloaded from Apple.

The company also has been developing new formats, including Kroger Marketplace, a multi-department store as large as 130,000 square feet, to take on Wal-Mart, and discount warehouse stores under the Food 4 Less, Foods Co, and Ruler Foods banners. The new “fresh fare” sections in 77 of its stores cater to upscale customers, offering wine and an expanded array of perishables.

Sinisi sees the market for natural and organic food nearly doubling by 2020. Kroger markets its own brand of natural and organic foods under the Simple Truth label, which it expects will reach $1 billion in sales by year end, after being introduced only in 2012. Sales of natural products continue to climb by double digits, Kroger says.

The Bottom Line

Kroger’s 43 straight quarters of same-store sales growth have proven it worthy of a higher P/E. At 17 times earnings, shares, now $52, would be worth $62.

Those changes, and an improving consumer economy, have given Kroger momentum. Unlike many retailers, its same-store sales rose 4.8% in its latest quarter. In the second, Kroger raised its full-year earnings guidance for the second time in 2014, to $3.22 to $3.28 a share, from $3.19 to $3.27, helped by the Harris Teeter deal. On a call with analysts, Kroger CEO W. Rodney McMullen said that it’s “well on our way to exceeding” its long-term earnings-per-share growth target of 8% to 11% this year.

The company generates more than $1 billion of free cash flow a year, enough to fund a $500 million buyback program starting in June. (It just completed a $1.1 billion buyback.) Kroger recently said it is adding 20,000 permanent jobs to its employee base of 375,000—risky, since its workforce is unionized, although it has reached tentative new contracts deals with several unions.

As Sinisi notes, major supermarket outfits represent just 54% of the U.S. retail-food market. “You have such a large industry that is so fragmented, that it comes down to differentiation and execution to lead long-term gains,” he says. Given its strong prospects, the tastiest item Kroger offers right now is its stock.

Here's some more information from from the Mergent database on Kroger and its competitors:

| Company Name |

Gross Margin |

Company Name |

Gross Margin |

| Wal-Mart Stores, Inc. |

24.82 |

Fresh Market, Inc. |

34.09 |

| Kroger Co. |

20.57 |

Star Markets Co., Inc. |

26.91 |

| Safeway Inc. |

26.27 |

J&J Snack Foods Corp. |

30.35 |

| Publix Super Markets, Inc. |

28.17 |

Big V Supermarkets Inc. |

26.42 |

| Supervalu Inc. |

14.76 |

Fairway Group Holdings Corp |

32.39 |

| Whole Foods Market, Inc. |

35.84 |

Nutritional Sourcing Corp |

32.58 |

| Food 4 Less Holdings Inc. |

20.77 |

Homeland Holding Corp |

23.04 |

| Roundy's Inc |

26.61 |

Natural Grocers By Vitamin Cottage Inc |

29.2 |

| Stater Bros. Holdings Inc. |

26.42 |

QKL Stores Inc |

17.1 |

| Ingles Markets, Inc. |

22.14 |

Great American Cookie Co., Inc. |

53.51 |

| Weis Markets, Inc. |

27.69 |

American Consumers, Inc. |

23.95 |

| Village Super Market, Inc. |

26.9 |

|

|

Here's what it says in the 2013 10K filing for Kroger:

MERCHANDISING AND MANUFACTURING

Corporate brand products play an important role in the Company’s merchandising strategy. Our supermarkets, on average, stock approximately 12,000 private label items. The Company’s corporate brand products are produced and sold in three “tiers.” Private Selection is the premium quality brand designed to be a unique item in a category or to meet or beat the “gourmet” or “upscale” brands. The “banner brand” (Kroger, Ralphs, King Soopers, etc.), which represents the majority of the Company’s private label items, is designed to satisfy customers with quality products. Before Kroger will carry a banner brand product we must be satisfied that the product quality meets our customers’ expectations in taste and efficacy, and we guarantee it. Kroger Value is the value brand, designed to deliver good quality at a very affordable price. In addition, the Company recently introduced two corporate brand lines, Simple Truth and Simple Truth Organic. Both brands are free from 101 artificial preservatives and ingredients that customers have told us they do not want in their food, and the Simple Truth Organic products are USDA certified organic.

Approximately 40% of the corporate brand units sold are produced in the Company’s manufacturing plants; the remaining corporate brand items are produced to the Company’s strict specifications by outside manufacturers. The Company performs a “make or buy” analysis on corporate brand products and decisions are based upon a comparison of market-based transfer prices versus open market purchases. As of February 2, 2013, the Company operated 37 manufacturing plants. These plants consisted of 17 dairies, nine deli or bakery plants, five grocery product plants, two beverage plants, two meat plants and two cheese plants.

STRATEGY EXECUTION

Our strategy focuses on improving our customers’ shopping experiences through improved service, product selection and price. Successful execution of this strategy requires a balance between sales growth and earnings growth. Maintaining this strategy requires the ability to develop and execute plans to generate cost savings and productivity improvements that can be invested in the merchandising and pricing initiatives necessary to support our customer-focused programs, as well as recognizing and implementing organizational changes as required. If we are unable to execute our plans, or if our plans fail to meet our customers’ expectations, our sales and earnings growth could be adversely affected.

2. Consider a firm that has the following two projects with the cashflows available in 1 year; assume a discount rate of 0%. Both states are equally likely. Show all your computations in the form of tables.

| |

Project A |

Project B |

| Good State |

130 |

150 |

| Bad State |

50 |

20 |

- (5 points) Suppose it has $20 due in one year. Which project would the firm choose?

- (5 points) Suppose the firm has $80 due. Which project would the firm choose?

- (5 points) What did you learn from your answers to parts a. and b.?

- Now assume the firm has senior debt outstanding with a face value of $25. Suppose the firm needs to invest $50 to obtain the rights to the cashflows to either of the two projects. It decides to issue junior debt.

- (5 points) Assume that the bondholders believe that equityholders will chose project A. What must the face value of this debt be to convince bondholders to buy the debt?

- (5 points) Which project will equityholders actually choose?

3. Answer the following questions:

- (15 points) Explain why a leveraged firm might act myopically. No more than ten sentences. I will stop reading after sentence number 10.

- (10 points) Explain why a leveraged firm is likely to take more risk than an unlevered firm (all other things being the same). No more than ten sentences. I will stop reading after sentence number 10.

4. Answer the following questions for Kroger for 2014 using the financial information below:

- (7 points) Compute the traditional Return on Assets number.

- (8 points) Compute the NOPAT Margin.

- (8 points) Compute Net Assets; treat the "Other long-term liabilities" as operational items.

- (7 points) Compute the Operating Return on Assets. Why is this number different from your answer in part a.?

| As Reported Annual Balance Sheet for Kroger |

|

|

| Report Date |

02/01/2014 |

02/02/2013 |

| Scale |

Thousands |

Thousands |

| Cash & temporary cash investments plus deposits-in-transit |

1359000 |

1193000 |

| Receivables |

1116000 |

1051000 |

| Inventory (FIFO less LIFO Reserve) |

5651000 |

5146000 |

| Prepaid & other current assets |

704000 |

569000 |

| Total current assets |

8830000 |

7959000 |

| Property, plant & equipment, net |

16893000 |

14875000 |

| Intangibles, net |

702000 |

- |

| Goodwill |

2135000 |

1234000 |

| Other assets |

721000 |

584000 |

| Total assets |

29281000 |

24652000 |

|

|

|

| Current portion of long-term debt including obligations under capital leases & financing obligations |

1657000 |

2734000 |

| Trade accounts payable |

4881000 |

4524000 |

| Accrued salaries & wages |

1150000 |

977000 |

| Deferred income taxes |

248000 |

284000 |

| Other current liabilities |

2769000 |

2538000 |

| Total current liabilities |

10705000 |

11057000 |

| Long-term debt including obligations under capital leases & financing obligations |

9653000 |

6145000 |

| Deferred income taxes |

1381000 |

800000 |

| Pension & postretirement benefit obligations |

901000 |

1291000 |

| Other long-term liabilities |

1246000 |

1145000 |

| Total liabilities |

23886000 |

20438000 |

| Equity |

5395000 |

4214000 |

| Total liabilities plus stockholders' equity |

29281000 |

24652000 |

Here are the Income Statements for Kroger, for the years ended January 31, 2013 and 2014.

| As Reported Annual Income Statement |

|

|

| Report Date |

02/01/2014 |

02/02/2013 |

| Scale |

Thousands |

Thousands |

| Sales |

98375000 |

96751000 |

| Merchandise costs, including advertising, warehousing & transportation |

78138000 |

76858000 |

| Operating, general & administrative expenses |

15196000 |

14849000 |

| Rent expenses |

613000 |

628000 |

| Depreciation & amortization expenses |

1703000 |

1652000 |

| Operating profit (loss) |

2725000 |

2764000 |

| Interest expense |

443000 |

462000 |

| Earnings (loss) before income tax expense |

2282000 |

2302000 |

| Income tax expense (benefit) |

751000 |

794000 |

| Net earnings (loss) including noncontrolling interests |

1531000 |

1508000 |

Solution to Midterm

1. A best-cost provider strategy seems to best describe Kroger. Here is some proof of this:

- The article talks about all sorts of products designed to attract upscale customers, such as the "fresh fare" section and the natural and organic food offerings.

- This is confirmed by the description in the 10K under "Merchandising and Manufacturing" where the different tiers are described, all of them seeming to be somewhat upscale and not at all generic.

- The Strategy Execution section of the 10K also emphasizes the improved service and product selection.

- On the other hand, this same section talks about price as being one of the foci and trumpets cost savings and productivity improvements.

- The article also mentions Kroger taking on Wal-Mart and discount warehouse stores under its Foods 4 Less, Foods Co and Ruler Foods banners.

- Finally, Kroger's gross profit margins are on the low end, with only three other competitors having lower margins.

This suggests that Kroger wants to compete on price, but at the same time it is trying to be upscale and also appeal to a variety of tastes.

2.

- The resulting cashflows would be:

| |

Project A |

Project B |

| |

Proj

Cashflow |

Senior Debt |

Equity |

Proj

Cashflow |

Senior Debt |

Equity |

| Good State |

130 |

20 |

110 |

150 |

20 |

130 |

| Bad State |

50 |

20 |

30 |

20 |

20 |

0 |

| |

|

|

70 |

|

|

65 |

The average payoff

to equityholders is $70 for project A and $65 for project B; hence they would choose project A.

- The resulting cashflows would be:

| |

Project A |

Project B |

| |

Proj

Cashflow |

Senior Debt |

Equity |

Proj

Cashflow |

Senior Debt |

Equity |

| Good State |

130 |

80 |

50 |

150 |

80 |

70 |

| Bad State |

50 |

80 |

0 |

20 |

80 |

0 |

| |

|

|

25 |

|

|

35 |

The average payoff

to equityholders is $25 for project A and $35 for project B; hence they would choose project B.

- We learn that perverse incentives can only exist if there is a likelihood of bankruptcy.

-

- If bondholders believe that equityhodlers will choose project A, then the payoff to bondholders will be Max(130-25, FV) in the good state and Max(50-25, FV) in the bad state. Clearly in the bad state, they are going to get 25, since they are being asked to contribute $50 and the FV has to be greater than or equal to 50. Hence to solve for the FV, we have the equation (FV+25)/2 = 50, given that the discount rate is zero. Hence FV=$75.

- The resulting cashflows for the junior debtholders would be:

| |

Project A |

Project B |

| |

Proj

Cashflow |

Senior Debt |

Junior Debt |

Equity |

Proj

Cashflow |

Senior Debt |

Junior Debt |

Equity |

| Good State |

130 |

25 |

75 |

30 |

150 |

25 |

75 |

50 |

| Bad State |

50 |

25 |

25 |

0 |

20 |

20 |

0 |

0 |

| |

|

|

|

15 |

|

|

|

25 |

Clearly,

equityholders will choose project B.

3.

- If a firm has debt that comes due in the short run, it will need to finance it, if it does not have enough short-term cashflow. Under these circumstances, if it also has long-term debt, that debt will be senior and will act as an overhang; that is, that debt will have to be repaid before the new (junioir) debt can be paid off. Some of the benefits from the issue of the new debt, therefore, goes to the existing senior debt and raises the effective cost of issuing new junior debt. Of course, the same conclusion applies to new equity issues, as well, since the new equity would also be junior. If the additional cost of new outside financing is high enough, the firm might prefer projects that pay off in the short run and can be used to pay off the short-term debt even if these short-term projects are less valuable.

- A leveraged firm is likely to take more risk than an unlevered firm because if the leveraged firm has a non-zero probability of bankruptcy, the downside of any new project is less relevant for equityholders than the upside in those states of bankruptcy. This is because in bankruptcy states, any additional losses are simply borne by the firm's debtholders.

4.

- The traditional Return on Assets is simply Net Profit after taxes/Total Assets = 1531000/29281000 = 5.23%

- The NOPAT margin is NOPAT/Sales. NOPAT = Net Income + Net Interest Expense after taxes = 1531000+443000(1-tax rate). The tax rate can be computed as income tax/Profit before taxes or (751000/2282000) = 32.91%. Hence NOPAT = 1531000+297209 = 1828209. Consequently, NOPAT margin = 1828209/98375000 = 1.86%.

- Net Assets = Net long-term assets + Operating Working Capital; net long-term assets = (total assets - total current assets)-(pension and post-retirement obligations + deferred income taxes + other long-term liabilities). According to Kroger's 10K, the "other long-term liabilities" refer to their self-insurance related to workers’ compensation costs and general liability claims and "other current liabilities" refers to the current portion of the same; hence it would make sense to treat it as an operating liability. Kroger has dererred income tax liabilities arising from a combination of deferred income tax assets (due to operating loss carryforwards) and deferred income tax liabilities (due to depreciation treatment); these would also be operating liabilities.

According to this analysis, net long term assets = (29281000-8830000)-(901000+1381000+1246000) = 20451000-3528000 = 16923000.

Operating Working Capital = (Current Assets - Cash)

- (Current Liabilities- Current portion of long-term debt)=(8830000-1359000)-(10705000-1657000)=7471000-9048000= -1577000.

Hence Net Assets =

16923000 - 1577000 = 15346000.

- The Operating Return on Assets equals NOPAT/Net Assets = 1828209/15346000 = 11.91%. This is twice the traditional ROA for two reasons: one, Krogers has a lot of cash that we have not treated as operating assets; two, Krogers has a lot of operating current liabilities that reduce the total amount of operating assets.

Lubin School of Business

MBA 673: Applying Financial Theory to Strategic Decision Making

Prof. P.V. Viswanath

Fall 2014

Final

- The exam is closed book.

- Time allowed is 2 hours.

- Explain all your answers; correct answers without explanations may not be given any credit at all.

- Make sure that your answer is clear and concise. Confused and rambling answers will lose points.

- If you answer a question, I have the discretion to award you some points, even if you are completely wrong. If you don't attempt the question at all, I can give you no points! So attempt every question.

1. Read the article below and answer the following questions in brief. Rambling answers will get points deducted. No more than one page of your answer booklet for each question.

- (10 points) The article notes that Lionsgate is risk averse, but also that its market capitalization has tripled in recent years and that its television unit has been very successful. What is the connection, if any, between the risk aversion and Lionsgate's success?

- (10 points) What operating strategies does Lionsgate use to minimize the volatility of operating cashflows?

- (10 points) How might you replace these risk-reducing operating strategies with financial risk minimization strategies that could then allow for more potentially profitable operating strategies?

Hollywood has a new star studio with a different approach to the film business, Jan 25, 2014, The Economist, Print Edition

WHEN some of Hollywood’s biggest studios were pitched a film based on a book series in which young people fight to the death at the behest of a totalitarian government, they passed on it. Bad call. Lionsgate, a fast-growing independent studio, grabbed it, and five years later “The Hunger Games” is one of the most successful film franchises in cinema history.

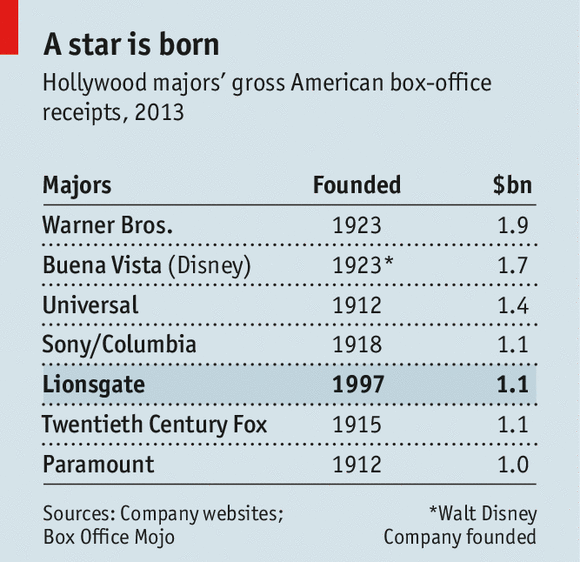

Like the films’ heroine, Katniss Everdeen (Jennifer Lawrence, pictured), Lionsgate has achieved a level of success no one predicted. American box-office figures for 2013 are now in, and they show that the second “Hunger Games” film helped Lionsgate to overtake Paramount and Fox (see table). Other than the surviving six “majors”, all dating from the age of Gloria Swanson and Rudy Valentino, the young challenger, founded only 17 years ago in Canada, is the only studio to have grossed more than $1 billion in a year, as it did in 2012 and 2013. Like the films’ heroine, Katniss Everdeen (Jennifer Lawrence, pictured), Lionsgate has achieved a level of success no one predicted. American box-office figures for 2013 are now in, and they show that the second “Hunger Games” film helped Lionsgate to overtake Paramount and Fox (see table). Other than the surviving six “majors”, all dating from the age of Gloria Swanson and Rudy Valentino, the young challenger, founded only 17 years ago in Canada, is the only studio to have grossed more than $1 billion in a year, as it did in 2012 and 2013.

Until recently Lionsgate was best known for its cheap but profitable horror and “genre” flicks, such as the gory “Saw” series and comedies featuring Tyler Perry, a black man who impersonates an old lady. In 2011 it fought off Carl Icahn, an activist investor, who had waged a three-year campaign to oust Lionsgate’s leaders and merge it with MGM, a legendary studio that had long lost its roar.

Lionsgate has risen by melding risk aversion with serious ambition. Jon Feltheimer, its boss, and Michael Burns, its dealmaking vice-chairman, have made a series of wise transactions, most notably a 2003 merger with Artisan Entertainment, which had a big film library, and the 2012 takeover of Summit Entertainment, another independent studio, for about $413m. Summit brought into Lionsgate’s den the “Twilight” franchise, an extraordinarily lucrative film series about a love affair between a brunette and a vampire. Since then Lionsgate’s market capitalisation has more than tripled, to over $4.1 billion.

Lionsgate’s television unit, which brings in about one-seventh of its revenues, has also had a run of hits, from “Mad Men”, about 1960s advertising folk, to “Nashville”, a tale of country-music stars. Its bosses want to keep expanding the TV side until it is about a third of the entire business.

Unlike the old Hollywood majors, it has no studio backlot: its offices are in a dull office block in Santa Monica. It licenses out most of the international rights to its films in advance, and thus it usually has no more than $15m at stake in films that may cost several times as much to shoot. This protects it against catastrophic losses like those that sank past challengers to the Hollywood majors (such as United Artists when “Heaven’s Gate” flopped in 1980). However, it also limits Lionsgate’s upside when its films do well abroad.

Lionsgate is lean, with only 550 or so employees compared with around 10,000 at Warner Bros. That means quicker decisions, and less chance that good ideas get stuck in “development hell”. The lemming-like majors all shove their blockbusters onto the market simultaneously in the summer holidays and at Christmas; Lionsgate slips out releases at times when punters are less overwhelmed with choice. It has been bolder than its rivals at releasing films for “on-demand” home viewing at the same time as they open in the cinemas: it did so with “Margin Call” and “Arbitrage”, two tales about dodgy financiers.

The majors are nowadays all part of large conglomerates, but Lionsgate has no sugar-daddy to run to if it hits hard times. However, its independence has also freed it to pursue opportunities others might neglect. Kevin Beggs, the boss of Lionsgate’s TV business, calls it “the Switzerland of television: we look everywhere, and we don’t have a conflict.” Other studios were slower to make programmes for Netflix and similar digital firms, because their parent companies owned broadcast networks and big cable channels that could be threatened by such services, says Alan Gould of Evercore, an investment bank.

Other studios are all doing, with varying degrees of success, some of what Lionsgate has been doing. They are investing in expensive, special-effect-laden “franchise” films featuring familiar characters: Lionsgate’s recent hits are proof that Hollywood is now a franchise business, says David Ellison, the boss of Skydance Productions, a film-financing company. They are also expanding their television sides, to offset the lumpiness of earnings from films. And some are, like Lionsgate, seeking to hedge risks. One way to do this is to sell stakes in big-budget productions to outside firms and wealthy individuals, the “modern Medicis”, in the words of Amir Malin of Qualia Capital, a private-equity firm.

With more “Hunger Games” films to come, analysts expect big profits for Lionsgate through to 2017. Some worry that it may then run out stardust. So Lionsgate needs to keep looking for new franchises. Mr Feltheimer hopes that “Divergent”, a book adaptation about a society that categorises citizens into different groups, could be its next mother lode. He will know in March, when its first film is released. But blockbusters’ ability to bust blocks is as unpredictable as ever. Lionsgate had great expectations for “Ender’s Game”, a military sci-fi film, but it grossed only $112m worldwide, barely covering its $110m production budget, let alone the marketing costs.

It is in the nature of Hollywood that unknowns rise rapidly to fame, only to burn out. A young studio can keep costs lean in the beginning, but when it hits a high, it becomes harder to plead poverty to actors and directors asking for more money. Look at New Line Cinema, founded in 1967, and latterly the “indy” division of Warner Bros. It rose in the 1980s, and went on to claim hits like the “Lord of the Rings” film trilogy, but it overstretched and spent too much on films that no one much wanted to see. Diverse revenue streams can help insulate failures, but do not insure against them. As Katniss Everdeen and any film fan knows, one can win one “Hunger Games” only to be thrown back in, and be forced to fight another round.

2. (15 points) Answer any one of the following six questions (you may not choose a question based on your team's work):

- How would a firm's hedging of input commodity prices affect its inventory management practices?

(The Liquid team may not choose this question.)

- The A-Team studied airlines as they progressed through bankruptcy. How would you expect an airline's customer service to vary as the firm goes through the pre-bankruptcy, bankruptcy and post-bankruptcy stages? Explain with respect to the theories that we discussed in class.

- The Yaay team looked at the effect of capital structure on the aggresiveness of Gap's marketing strategy. Why might higher financial leverage cause a firm to be more aggressive (not just in their marketing strategy)? Explain with respect to the theories discussed in class.

- Answer the following two questions:

- The A-team found no pattern in how their measure of financial leverage, which they used in their regressions, varied over the different stages of bankruptcy. Why do you think this might have been the case?

- What other measures of probability of bankruptcy might you have used if you were redoing the A-team's regressions, instead of the measure that they did use.

- The United Nations Team looked at how the financial leverage of pharmaceutical companies affected their R&D. One way to examine this would be to run a regression of R&D expenses on debt. However, this might simply show how pharmaceutical companies finance their R&D; i.e. it may show the effect of R&D on capital structure, rather than the other way around. How did the United Nations Team resolve this problem?

- How would you expect a pharmaceutical firm's financial leverage to affect its R&D? Explain with respect to the theories discussed in class.

(The United Nations team may not choose this question.)

3. In a 2012 research paper written by Jennifer Brown and David Matsa of Northwestern University titled "Boarding a Sinking Ship? An Investigation of Job Applications to Distressed Firms," they report the following:

This paper examines the impact of corporate financial distress on firms’ ability to attract job applicants. Using novel, proprietary data from a leading online job search platform, we find that firms’ financial health impacts job seekers’ perceptions and behavior. First, using survey responses, we find that job seekers accurately perceive firms’ financial health, as measured by the companies’ credit default swap prices and other proxies. Second, we analyze responses to job postings by major financial firms during the recent financial crisis and find that these perceptions affect job seekers’ application decisions. An increase in an employer’s financial distress results in fewer applicants for job openings at the firm. We find fewer applications even when comparing applications to the exact same positions before and after entering distress. These effects are particularly evident in locations where the social safety net provides workers with weaker protections against unemployment and for positions requiring advanced training.

- (5 points) The researchers find that "job seekers accurately perceive firms’ financial health, as measured by the companies’ credit default swap prices and other proxies." Does this mean that job seekers actually look at credit default swap prices? If not, then how could they figure out the firms' financial health?

- (10 points) "An increase in an employer’s financial distress results in fewer applicants for job openings at the firm." Why should perceptions of increased financial distress cause job-seekers to turn down job possibilities?

- (10 points) "These effects are particularly evident in locations where the social safety net provides workers with weaker protections against unemployment..." What is the connection between the existence of a social safety net and reluctance to apply for jobs with firms in financial distress?

- (5 points) "These effects are particularly evident ... for positions requiring advanced training." What is the connection between a job requiring advanced training and reluctance to apply for jobs with firms in financial distress?

- (5 points) If you were a corporate manager, how would this research affect your actions? Would it depend on the kind of industry you were in? If so, how?

4. Suppose the market has the following information: Viarant Inc. is worth either $200m (the good state, with probability 0.3) or $100m (the bad state, with probability 0.7). Viarant also has the right to invest in a new government project, which is likely to bring it an NPV of $30m. (in the good state) or $20m. (in the bad state). Viarant's management, however, knows exactly what state the company is in. The project requires an investment of $50m. but the firm can obtain this funding from a private investor to whom it can reveal its information credibly and without worrying that the information will be leaked to its competitors.

- (5 points) What will be the market value of the company?

- (10 points) It turns out now that the private investor is not available to invest in the deal and Viarant must issue new equity to finance the project. Will Viarant raise the outside equity and invest in the project, if the firm is actually in the good state? What if it is in the bad state? What will be the market value of the company?

- (5 points) What if the funds can be raised in the bond market? Are you answers to the firm's likelihood of investing in the bad and good state likely to change?

- (5 points; choose whichever of the two is applicable to you)

- Suppose your answer in part b. was that Viarant will invest in the bad state and the good state. If you are faced with a similar situation except for the fact that the investment required is much greater than $50. Is your answer likely to change? Explain.

- Suppose your answer in part b. was that Viarant will invest in the bad state, but not in the good state. If you are faced with a similar situation except for the fact that the investment required is much greater than $50. Is your answer likely to change? Explain.

Solutions to Final

1.

- There is probably no connection; the risk aversion is a strategic decision, while the successful investments are either the result of intelligent and knowledgeable managers or simply luck. Alternatively, the decision not to take too much equity risk could free managers to focus on making good movies and television shows.

One possible connection is that the lean business model, which is risk-reducing (lower operating leverage), may have the side-effect of quicker decision-making.

-

- As the article notes, "(Lionsgate) licenses out most of the international rights to its films in advance, and thus it usually has no more than $15m at stake in films that may cost several times as much to shoot. This protects it against catastrophic losses.

- It has no studio backlot: its offices are in a dull office block in Santa Monica. This means it has low fixed costs and low operating leverage.

- Lionsgate also does not take too much risk in its choice of subjects -- it tends to make "franchise" films starring known characters; thus, until recently it made cheap but profitabel horror and "genre" flicks such as the gory "Saw" series and the Tyler Perry comedies. Now, it's making sequels to the Hunger Games.

- It is also making television films to reduce the lumpiness of movie revenues and also to diversify.

- Even though the article calls this bold, releasing movies for at-home viewing and cinema viewing simultaneously may be a kind of diversification.

- Similarly, releasing movies at non-holiday times may be tantamount to staying out of high-stakes, but high risk-situations.

- It would be difficult to use financial risk minimization strategies instead of these operating strategies. One possibility would be to sell part of its equity to outside investors. This would reduce the risk of the current Lionsgate owners by allowing them to diversify their private portfolios. The volatility of movie and television cashflows is difficult to offset with positions in derivative securities, since there are no such derivatives. Perhaps Lionsgate could buy some sort of downside insurance for its films, once they are made; however, chances are such insurance would be expensive. There are, however, insurance contracts called "completion guarantees" that allow firms to insure against operational risks during the actual filming.

2.

- If a firm has hedged input commodity prices, then it is less likely to keep inventories of inputs, since storage of the input good protects the firm from having to buy inputs at a higher price. Of course, it cannot take advantage of a drop in input prices, either. Possibly also the increased certainty of operating cashflows may allow the firm to make investments that it might not have otherwise made.

- When the firm is in financial distress, prior to bankruptcy, it would probably want to raise as much liquid funds immediately as possible; this would lead the firm to be myopic and not invest in product quality. As a result, its customer service would probably suffer. In bankruptcy, the firm would have some respite because creditors do not have to be paid immediately; as a result, it is likely to try and improve customer service in order to improve revenues and operating profits. Post-bankruptcy, there might be a slight slip in customer service depending on the extent of the firm's post-bankruptcy leverage. Alternatively, service might remain good because financial reorganization is likely to have mitigated agency problems.

- The greater a firm's leverage, the greater the risk it is likely to take because the equity holders have the equivalent of a call option on the firm's assets. This means greater aggressiveness, since aggressiveness generally implies risk.

-

- This may have been because they were measuring financial leverage using book values of debt and equity; book values are not as sensitive to the true underlying value of the firm and do not change that much even if the firm is closer to financial distress. Book values are based on historical information, not on forecasts of future cashflows.

- One could use the Altman Z-score or the Merton probability of bankruptcy based on an option-type model. In general, one could use a combination of current liquidity ratios and long-term leverage ratios to measure and predict financial distress.

- The United Nations Team resolved the question of endogeneity of leverage changes by looking at changes in leverage consequent upon an acquisition. Such leverage changes are less likely to be driven by changes in R&D expenditures. Hence the association between leverage changes and R&D expenditure changes in such cases are likely to be due to the effect of the leverage change on R&D expenditures. This is similar to the strategy used by Judith Chevalier in her study of supermarket debt and pricing decisions.

- As suggested in our answer to part c., leveraged pharmaceutical firms might choose to be more aggressive in their R&D strategies by choosing to study far-reaching drugs with lower probabilities of success but a higher payoff in case of success. On the other hand, one may argue that leveraged firms would be under pressure to make interest and principal payments on the debt leading to myopia, i.e. quick-results-yielding research. However the expectation of having to act in such a myopic way would probably lead a pharmaceutical firm to sell long-term bonds, with maturities perhaps as long as 30 years or more in order to be freer to pursue R&D opportunities; the long duration of the bonds would reduce the myopia.

3.

- Job seekers probably do not actually look at credit default swap prices. However, they probably investigate business in which they are looking for jobs by searching on Google. Also, they might obtain information through word-of-mouth from current or past employees of the firm. There are many websites that follow firms; even though these websites are usually directed towards valuation of the stock, they could be used by job seekers to get information about the firm, as well.

- If the firm is in financial distress, then the individual is more likely to lose his or her job because of the firm going bankrupt. This would cause the individual to lose any investment in human capital that s/he might have made in the firm. Also, the individual would have to spend time looking for another job, during which time s/he might not be earning. A firm in financial distress may offer lower salaries; however, then the reason for the reluctance to apply would be not the financial distress, but the lower compensation.

- If there is a social safety net, then the individual would not lose as much in case of job loss due to the firm's bankruptcy. Essentially, the social safety net functions as insurance. Thus, the loss of income during the job-search period would be alleviated by the existence of the social net. Furthermore, with anti-firing provisions, the likelihood of job loss is also lower. As such, the job seeker would be less worried about the firm's financial distress and possible bankruptcy.

- Individuals with advanced training may be more likely to be informed about the financial situation of the firm in which they are seeking jobs. Also, these individuals may have to invest more in firm-specific human capital to add value, as opposed to jobs like a cleaner or a driver, which wouldn't vary that much from one job to another.

- If it were crucial for my company to obtain good employees, and well-educated and well-trained employees, then I would ensure that my firms was not highly leveraged. This is likely to be the case, for example, in software firms, tech firms or firms that generate R&D.

4.

- The market value of the company will be (0.3)230 + (0.7)120 = $153.

- If the company has to issue outside equity, and the company would be issuing equity and raising funds, independent of the true state, the issuance will not reveal information. In this case, an outside investor asked to invest $50 would ask for (50/203) of the firm (the existing firm worth $153 plus the $50 he's putting in). Inside investors would get (153/203) of the firm, which would be worth (153/203)280 = 211 in the good state and (153/203)170 = $128 in the bad state. Even in the good state, this issuance of equity is worth it for existing equity holders, since $211 > $200, which they would get otherwise, losing the $30 of project NPV. In the bad state, of course they would issue equity ($128 > 100). The market value of the firm thus would be $203 after the issuance of the $50 equity, since the equity issuance would reveal no new information.

- If funds can be raised in the bond market, there would be even less of an information asymmetry problem; hence the firm would issue bonds in both the good and the bad state and it would definitely undertake the investment.

- i. Since Viarant will invest in the bad state, as well as the good state, the second part of the question is irrelevant. If the investment required is much greater than $50, it would exacerbate the information asymmetry problem and for sufficiently large required investment, the firm may choose to not invest in the good state. Currently, the existing shareholders only have to sell 50/203 or about 25% of the firm, which leads to their losing (30 - (211-200)) or $19m. in the good state. If they have to raise more equity, they would have to sell more of the firm and potentially lose more of the project NPV in the good state.

ii. If you had the wrong answer in part b. (probably because of a computational error) and you concluded that they would not invest in the good state, you would continue to conclude that they would

not invest in the good state for the reasons stated in part i. of this question.

|

|