This is a student assignment on Corporate Governance from Fall 2001. It is begin presented here simply as an example of the kind of analysis that you should be looking at. Note that this is not a recommended solution -- not everything in here is "correct." In particular, note my comments.

10 out of 10.

Overall, the information obtained on the company, as well as the analysis

is very good. Note my comments in

red, throughout. Highlighted in

green are parts from your text in order to point out the parts to which I am

responding in my comments.

1.

The Company.

Staples, Inc. and subsidiaries pioneered the office products

superstore concept and is a leading office products distributor, with a total of

1,307 retail stores located in the United States, Canada, the United Kingdom,

Germany, the Netherlands and Portugal as of February 3, 2001. In addition,

Staples has catalog, electronic commerce and contract stationer businesses.

The Standard Industrial Classification for Staples Inc. is Retail

Miscellaneous Shopping Goods Stores.

Staples has four reportable segments:

North American Retail, Contract and Commercial, Staples.com, and European

Operations. The Staples North

American Retail segment consists of the US and Canadian operating units that

operate office supply stores. The

Contract and Commercial segment consists of Staples Direct, Contract, Quill

Corporation and Staples Communications, which sell office products, supplies and

services directly to businesses throughout the US and Canada.

The Staples.com segment includes the operations of Staples e-commerce

businesses. The European Operations

segment consists of six operating units that operate office supply stores in the

United Kingdom, Germany, the Netherlands and Portugal and sell office products

and supplies directly to businesses throughout the United Kingdom and Germany.

What is the source for this information?

2.

Officers

According

to the By-Laws of Staples Inc., the officers of the corporation shall consist of

a president, a treasurer and a secretary and such other officers, including

without limitation a chairman of the board of directors and one or more vice

presidents, assistant treasurers and assistant secretaries, as the board of

directors may from time to time determine.

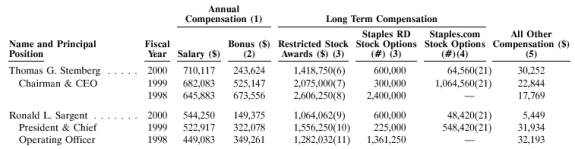

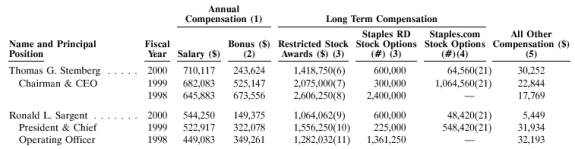

Exhibit A shows the individuals at the top of the companys governance. The top two officers at the company are Thomas G. Stemberg

(Chairman & CEO) and Ronald L. Sargent (President and Chief Operating

Officer). Both officers receive a

substantial amount in restricted stock awards (to ensure that they do not sell

or transfer the stock after receiving it) besides the salary.

What is the source for this information?

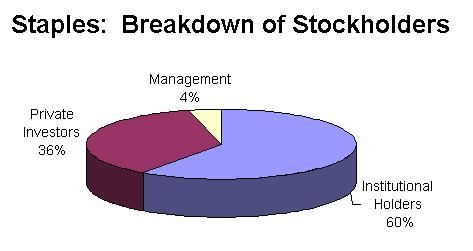

According to the By-Laws, the officers are not required to own stock of

the company. Exhibit C shows that

all executives and directors combined own less than 4% of the companys stock,

a relatively little amount. Since

they are not required to own stock, potentially this can create a conflict with

the shareholders because the interests of the management are not aligned with

their interests. On

the other hand, by choosing not to hold a significant amount of shares, the

companys incumbent management yields a great deal of control to large

shareholders and institutional investors. I

dont think this is true. Most of

the control of management comes from their ability to take day-to-day decisions

without much oversight; this is independent of stock ownership.

In order for management to better represent the shareholders and maintain

the high risk high reward philosophy, the Boards Compensation

Committee has adopted a PARS plan (Performance Accelerated Restricted Stock

Awards) for certain key executives. Under

the plan, shares of Staples RD Stock are granted to executives in consideration

for services. First, this provides

an incentive for the executives to provide outstanding services in pursuit of

financial rewards. Second, by

rewarding them with stock, the Board ensures that the interests of management

coincide with the interest of shareholders.

The shares are restricted the executives are not free to sell

or transfer them until they vest in 2005, which provides a guarantee that

the management will not easily dispose of common interests shared with the

other shareholders. Therefore, even

though officers are not required to be shareholders, they still become

shareholders.

Very

good analysis.

The

purpose of the stock options that represent the amount of $600,000 for Stemberg

and Sargent, and are substantial for other key executives as well, is to provide

an incentive for the management to prioritize the stockholder value maximization

goal. The companys Proxy clearly

states:

Managerial Performance:

For the 26 weeks ended 8/4/01, sales rose 5% to $4.98B. Net income fell 8% to $79.9M. Results reflect higher customer traffic in all channels, offset by a lower gross margin, & the absence of store closure credit. (E-trade)

Explain

how this is related to corporate governance.

In general, the company takes pride in its corporate governance system when it comes to responsiveness to shareholders interests and needs. The company is followed by 14 analysts (BRIDGE) (If your purpose is to indicate the source of the information, use a footnote and give the name in full, such as Bridge Information Systems), which carries great implications for the management. The number of analysts, which is relatively high for Staples compared to other publicly traded companies, implies that the management must prioritize shareholders interests by increasing the stock value by enhancing growth and earnings. A consensus among many analysts that the forecast for earnings is not bright, or that the stock is overvalued, will cause a plunge in stock price and may lead to a retaliatory actions from stockholders, who will demand explanation from the management. The management in this case would not be able to claim that so many analysts are wrong and will have to take responsibility and may face a prospect of being replaced. Therefore, it is in the best interests of the management to try to have good forecasts from many analysts who follow the company. Currently the company is doing a great job the Wall Street consensus is buy. Good.

3.

The

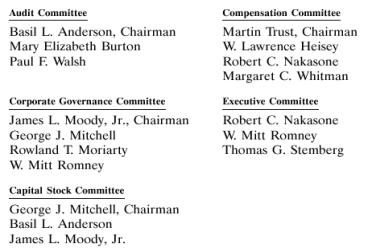

Board of Directors

According to the corporate By-Laws, the Board of Directors cannot consist

of fewer than five members. The

members of the incumbent Board number sixteen; the Exhibit C shows the

individuals and their affiliations. The

size of the board may be problematic in itself: Business

Week, when rating the companies (you

mean companys singular? No,

it looks like you mean companies plural in this case, you should leave

off the definite article in front) Board efficiency, gave higher grades

to companies that had fewer than 15 members serving on the Board because a

number greater than that would restraint the Boards efficiency and

effectiveness. However, most of the

members are relatively young with the average age in the middle 50s (only one

member is 71 years old), suggesting that the directors can take an active role

in their work.

Again,

whats the source?

The Board deserves a low grade

for independence from management because one of the members is CEO, Thomas G.

Stemberg, and the other is President and Chief Operating Officer Ronald L.

Sargent. Having these two highest

ranking corporate officers on the Board means that the board often looks after

the interests of the management, not shareholders.

In addition, Mr. Stemberg also serves on the Executive Committee, which

is authorized to exercise all the powers of the Board in the management and

affairs of Staples (2001 proxy).

Is

this uncommon?

Some other members of the Board also hold management positions in Staples

Inc. For example, James L. Moody is

a Lead Director at Staples and David G. Lubrano is a Business Consultant at

Staples. This means that there is

an insider on the Corporate Governance committee as well.

These two members are not independent in their decisions because they are

insiders and have an incentive to make decisions that benefit the incumbent

management.

In

terms of accountability to stockholders the company deserves a high grade

because under the 1990 Director Stock Option Plan, during the fiscal year ended

February 3, 2001, directors were compensated exclusively through equity rather

than receiving a portion of their compensation in cash (with the exception of

Senator Mitchell who receives a yearly cash compensation of $75,000).

The purpose of the Director Stock Option Plan is to make the directors

think more like shareholders, since they in fact become shareholders by

providing their services. However,

Staples does not make stock ownership one of the eligibility requirements for

the Board and every director owns less than 1% of companys stock, with the

exception of CEO, who owns 1.69%, still a considerably small amount (Exhibit B).

This year only 1 director is up for reelection, but next year 4 directors

will have to be reelected, which makes them more accountable for their actions.

All

of the board members are competent in their job most of them are CEOs and

directors at other companies and have a substantial experience in the area of

corporate decision making. However,

those of them who are still serving active roles in other companies (only two

are retired) potentially can be a source of conflict of interest between their

companies interests and the interests of Staples.

In addition, their duties at other firms prevent them from dedicating

their time and effort to serving the shareholders of Staples.

Therefore, it is doubtful whether they can take a very active role in

running the Board.

4.

Stockholders

Judging by the large amount of disclosed information available about the

company, it can be said that the shareholders have a large degree of control

over the company. When the company

information is readily made public in a timely fashion, this means that the

management acts in the interests of the public, stockholders in particular.

The top Institutional holder of the

company stock is Fidelity Management & Research Corporation with 14.33% of

the outstanding number of shares, followed by Wellington Management Company with

8.78%.

|

Report

Date |

||||||

|

66,538,659

|

13,653,953

|

1,063,953,157

|

14.558%

|

0.215%

|

03/31/2001

|

|

|

40,797,068

|

4,387,900

|

652,345,117

|

8.926%

|

0.437%

|

03/31/2001

|

|

|

18,493,000

|

1,764,000

|

295,703,070

|

4.046%

|

4.736%

|

03/31/2001

|

|

|

17,451,820

|

5,952,655

|

279,054,602

|

3.818%

|

0.134%

|

03/31/2001

|

|

|

9,239,306

|

1,271,169

|

147,736,503

|

2.021%

|

0.047%

|

03/31/2001

|

|

|

7,024,122

|

183,184

|

112,315,711

|

1.537%

|

0.057%

|

06/30/2001

|

|

|

6,887,203

|

-719,192

|

110,126,376

|

1.507%

|

0.126%

|

03/31/2001

|

|

|

6,882,722

|

-1,251,411

|

110,054,725

|

1.506%

|

0.068%

|

03/31/2001

|

|

|

6,800,000

|

-1,350,000

|

108,732,000

|

1.488%

|

0.049%

|

03/31/2001

|

|

|

5,728,200

|

409,600

|

91,593,918

|

1.253%

|

1.386%

|

03/31/2001

|

Source:

E-trade.

Staples

is not a disproportionate share of any of these institutional holders total

assets: they are well diversified.

(What is the relevance of this comment?)

Exhibit D shows the top mutual fund holders of Staples stock,

with Fidelity Magellan Fund leading the list with 4.80%.

Compared

to other companies in the same industry (how

do you know this? Whats your

source?), relatively large percentage of the outstanding stock is owned

by institutional investors and very small percentage is owned by the management

(Executive Officers and the Board of Directors), putting the control of the

company largely in the hands of shareholders, such as private and institutional

investors. Therefore, it can be

concluded that the average stockholder of Staples is an institutional investor.

Is this good or bad?

5.

Conflicts of Interest (in recent occurrences)

A.

$50 Million Stock Buyback plan.

(Reuters)

Following the events of September 11th, and the following

removal of buyback restrictions by SEC, Staples announced on 9/20/2001 its plan

to buy back $50 Million worth of stock. Staples

said the repurchased stock will be added to the company's treasury shares and

may be used for employee benefit and stock option programs, as well as other

corporate programs. (Source:

Reuters)

Equity repurchases may

provide a way of increasing insider control in companies because they reduce the

number of outstanding shares. The

company and its employees will end up holding larger percentage of the stock,

and consequently, having greater control. On

the other hand, equity repurchasing is traditionally considered to be an action

that benefits both the firm and its stockholders because stockholders benefit

from resulting price appreciation, advantageous tax treatment, and the voluntary

nature of surrendering the shares for cash.

Good.

B.

Staples Inc. Names Basil L. Anderson Vice Chairman.

(Business Wire)

Sep 19, 2001 -- Basil L. Anderson, 56, the former chief financial officer

and treasurer who helped reshape Campbell Soup Co., has joined Staples Inc. as

vice chairman. Mr. Anderson has to

report directly to Ronald L. Sargent, the President of the company. The potential problem is that Mr. Anderson serves on the

Board of Directors since 1997 and is a chairman of the Audit Committee.

His appointment puts one more insider on the Board and aligns the

interests of the Board more closely with the management, as opposed to

shareholders. The independence of

the Board is greatly reduced by this development.

C.

Recapitalization. (Business Wire, 10K, 10Q)

During

1999, Staples stockholders approved a Tracking Stock Proposal which allowed the

issue of new series of common stock, Staples.com Stock, intended to track the

performance of e-commerce business, which operates under the name Staples.com.

Staples' existing common stock was reclassified as Staples Retail and Delivery

common stock ("Staples RD Stock"), intended to track the performance

of Staples Retail and Delivery. On

March 15, 2001, the Board of Directors approved a proposal to seek stockholders'

approval to effect a recapitalization by reclassifying the separate series of

Staples.com Stock and recombine the two outstanding series of Staples' common

stock into a single series representing all of Staples' businesses. At an annual

meeting, the stockholders were asked to consider and approve a proposal to amend

Staples' certificate of incorporation to effect the recapitalization and to

rename the resulting single series of common stock as "Staples Common

Stock." By integrating the catalog operation with Staples.com, Staples

hopes to achieve synergies and efficiencies in how it markets to and services

customers in both operations.

Following

the public announcement of the proposed reclassification, various stockholders

of Staples expressed concerns that the members of the Board of Directors would

benefit from the exchange of their shares of Staples.com.

On March 29th, 2001, the Board met to discuss these

stockholder concerns and reached the consensus that the public must be assured

that in order to preserve the highest level of integrity and good corporate

governance, the Reclassification Ratio is fair to all stockholders and that any

appearance of conflict of interest between the Board and the shareholders.

The Board concluded that the financial interest of the directors must be

eliminated and that all directors would agree to rescind their purchases of

Staples.com Stock and cancel all of their options for Staples.com stock.

Beginning March 23, 2001, a total of 12 lawsuits were filed in Delaware Chancery Court by Staples RD stockholders against Staples and each of its directors. The shareholders alleged that the proposed recapitalization violates Delaware General Corporation Law, staples contractual obligations, and the fiduciary duties of Staples directors.

Looks

like this para should come before the sentence starting On March 29th

in the previous para. Right?

On

April 1, 2001, the Board ratified the repurchase by Staples of all outstanding

shares of Staples.com held by the directors at their original purchase price of

$3.25 per share, without interest, and the cancellation of all options for

Staples.com stock held by the directors.

Is this price too high or too low? What

was the stock price as of April 1, 2001?

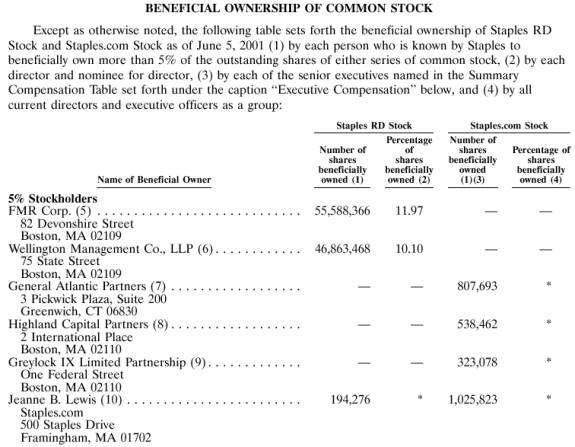

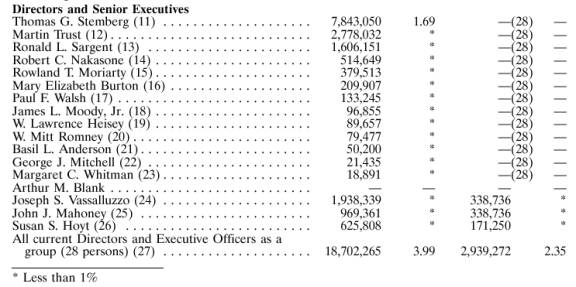

Exhibit

B shows the ownership Staples RD stock and Staples.com stock by institutional

investors and by the management and the Board members.

Overwhelming number of shares of Staples.com Stock was owned by the

company insiders: As of June 5, senior executive officers owned 34% and the

employees owned 72% of the outstanding Staples.com stock.

On Aug. 27, 2001 the shareholders (which

shareholders? I dont think this

refers only to Staples.com shareholders; tracking stocks dont usually work

that way.) voted to reclassify Staples.com tracking stock into Staples

common stock. The proposal passed

with 85% of the vote from the shareholders.

This high rate of approval can be explained by a fact that nearly 96% of

Staples.com stock was owned by the company insiders, who overwhelmingly cast the

YES votes on reclassification. Therefore,

the recapitalization, even though approved by the shareholders, does not

necessarily benefit many of them and was certainly opposed by many

outsiders.

Need

a little more analysis of the tracking stock issue.

Also, what about bondholder-stockholder conflict?

Why

is Exhibit E here?

EXHIBIT

A

Corporate

Governance

|

John K. Barton |

|

|

|

Executive

Vice President, Real Estate |

|

Joseph G. Doody |

|

|

|

President,

Staples Contract and Commercial |

|

Deborah G. Ellinger |

|

|

|

Senior

Vice President, Strategy |

|

Richard R. Gentry |

|

|

|

Executive

Vice President, Merchandising |

|

Shira G. Goodman |

|

|

|

Executive

Vice President, Marketing |

|

Edward Harsant |

|

|

|

President,

North American Superstores |

|

Susan S. Hoyt |

|

|

|

Executive

Vice President, Human Resources |

|

Jacques Levy |

|

|

|

President,

International |

|

Jeanne B. Lewis |

|

|

|

President,

Direct.com |

|

Brian T. Light |

|

|

|

Executive

Vice President and Chief Information Officer

|

|

John J. Mahoney |

|

|

|

Executive

Vice President and Chief Administrative Officer |

|

Lawrence J. Morse |

|

|

|

President,

Quill |

|

Ronald L. Sargent |

|

|

|

President

and Chief Operating Officer |

|

Thomas G. Stemberg |

|

|

|

Chairman

of the Board and Chief Executive Officer

|

|

Jack VanWoerkom |

|

|

|

Senior

Vice President, General Counsel and Secretary

|

|

Joseph S. Vassalluzzo |

|

|

|

Vice

Chairman |

EXHIBIT

B

EXHIBIT

C

Directors

|

Basil Anderson |

|

|

|

Executive

Vice President and Chief Financial Officer, Campbell Soup Co.

|

|

Arthur M. Blank |

|

|

|

Retired

Co-Chairman of the Board of Directors, The Home Depot, Inc.

|

|

Mary Elizabeth Burton |

|

|

|

President

and Chief Executive Officer, BB Capital, Inc.

|

|

George J. Mitchell |

|

|

|

Former

U.S. Senator, Former Majority Leader, Special Counsel Verner, Liipfert,

Bernhard, McPherson & Hand |

|

James L. Moody, Jr. |

|

|

|

Retired

Chairman of the Board of Hannaford Bros. Co. |

|

Rowland T. Moriarty |

|

|

|

Chairman

and Chief Executive Officer, Cubex Corporation

|

|

Robert C. Nakasone |

|

|

|

Chief

Executive Officer |

|

W. Mitt Romney |

|

|

|

Managing

Director and Chief Executive Officer, Bain Capital, Inc.

|

|

Ronald L. Sargent |

|

|

|

President

and Chief Operating Officer, Staples, Inc.

|

|

Thomas G. Stemberg |

|

|

|

Chairman

of the Board and Chief Executive Officer, Staples, Inc.

|

|

Martin Trust |

|

|

|

President

and Chief Executive Officer of Mast Industries, Inc., a wholly-owned

subsidiary of The Limited, Inc. |

|

Paul F. Walsh |

|

|

|

President

and Chief Executive Officer, iDeal Partners

|

|

Margaret C. Whitman |

|

|

|

President

and Chief Executive Officer, eBay |

|

Leo Kahn |

|

|

|

Chairman

Emeritus, Co-Founder of Staples, Inc. |

|

W. Lawrence Heisey |

|

|

|

Director

Emeritus, Chairman Emeritus, Harlequin Enterprises Ltd.

|

|

David G. Lubrano |

|

|

|

Director

Emeritus, Private Investor and Business Consultant, Staples, Inc.

|

EXHIBIT

D

(Source Yahoo! Finance)

|

Top Mutual Fund Holders of SPLS |

|

Shares |

Value |

|

Fidelity Magellan Fund Inc |

4.80% |

22,300,000 |

$328,702,000 |

|

Janus Fund |

3.95% |

18,326,795 |

$270,136,958 |

|

Fidelity Equity-Income Fund |

1.65% |

7,661,538 |

$112,931,070 |

|

Fidelity Independence Fund |

|

5,100,000 |

$75,174,000 |

|

Fidelity Puritan Fund Inc |

|

4,555,700 |

$67,151,018 |

|

Vanguard Index 500 Fund |

|

4,065,023 |

$59,918,439 |

|

Investment Company Of America |

|

4,000,000 |

$58,960,000 |

|

Janus Strategic Value Fund |

|

3,512,876 |

$51,779,792 |

|

College Retirement Equities Fund-Stock Account |

|

3,162,468 |

$46,614,778 |

|

Putnam Fund For Growth And Income |

|

3,020,200 |

$44,517,748 |

EXHIBIT

E

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||